Vea también

08.04.2025 07:35 AM

08.04.2025 07:35 AMOn Monday, the EUR/USD currency pair continued swinging wildly back and forth. What's happening across all markets now can be described in many ways: panic, chaos, madness, apocalypse. However, the core issue remains the same: there are no logical or technical movements. News is pouring in non-stop, market participants constantly shift sentiment, and price directions change just as frequently. Forecasting price movement even a day ahead seems like an impossible task.

Even yesterday, during the trading day, reports emerged that Trump might suspend all tariffs for 90 days. An hour later, the White House said the president never said that. A few hours later, it was reported that Trump plans to impose additional tariffs on China if it dares to retaliate against what the U.S. calls "fair" tariffs. Naturally, market direction changes five times a day! We are currently in the initial phase of a global trade war. High volatility will likely persist for a while, just as we warned earlier because major players and alliances are now preparing retaliatory sanctions against the U.S.

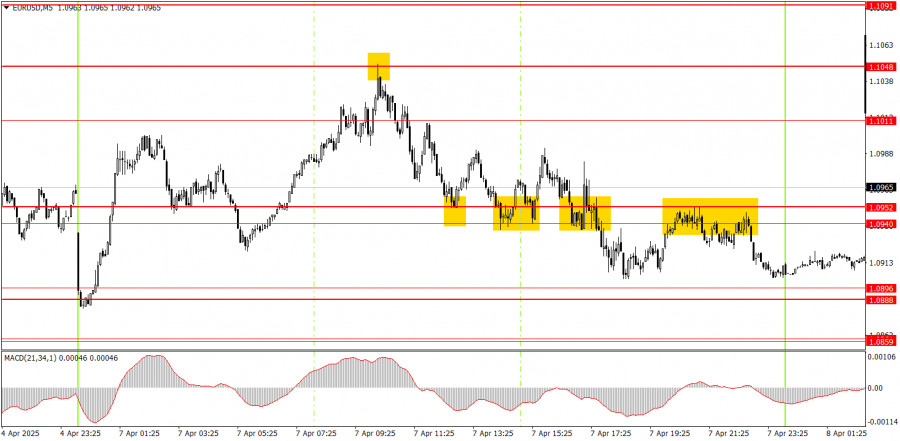

On Monday, several trading signals were formed in the 5-minute timeframe. Trading could have been initiated from the 1.1048 level, but let's reiterate once more—movements are currently sharp and erratic. The price often pierces through multiple levels and reverses direction within the hour. Beginners in trading should exercise extreme caution at this time.

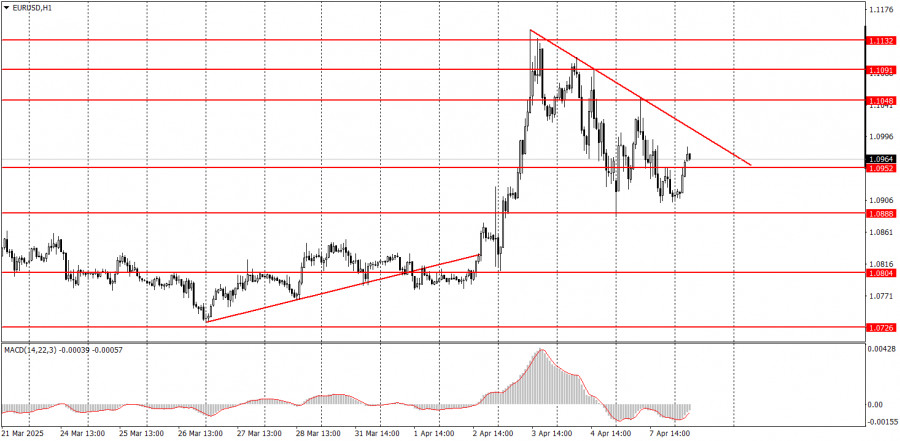

In the one-hour timeframe, the EUR/USD pair continues its upward trend. It is unknown how long this will last, as no one knows how many more tariffs Trump plans to introduce. Multiple escalations in the trade war cannot be ruled out since many countries are preparing mirror-like retaliations against the U.S. Trump has already said that any response will provoke new tariffs from Washington.

On Tuesday, markets will likely remain in a state of shock. We won't attempt to forecast movements, as it is quite challenging to describe what is happening globally.

For the 5-minute timeframe, relevant levels to watch on Tuesday are: 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292.

On Tuesday, no macroeconomic reports will be released in either the U.S. or the Eurozone—but at this point, they are hardly relevant. The market will continue to focus exclusively on any and all news related to the global trade war and react only to that.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.3282

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.1320

GBP/USD: plan para la sesión europea del 30 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra se prepara para un nuevo salto, pero

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió allí. En mi pronóstico de a mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.3342

Ayer no se formaron puntos de entrada al mercado. Propongo echar un vistazo al gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico matutino, presté atención

GBP/USD: plan para la sesión europea del 28 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra formó un nuevo canal, manteniendo las posibilidades

El pasado viernes no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué ocurrió. En mi pronóstico matutino presté atención al nivel 1.1391

Ayer se formaron varios puntos excelentes de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel

Ayer no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué pasó allí. En mi pronóstico matutino presté atención al nivel de 1.1358

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.