Vea también

17.03.2025 06:17 PM

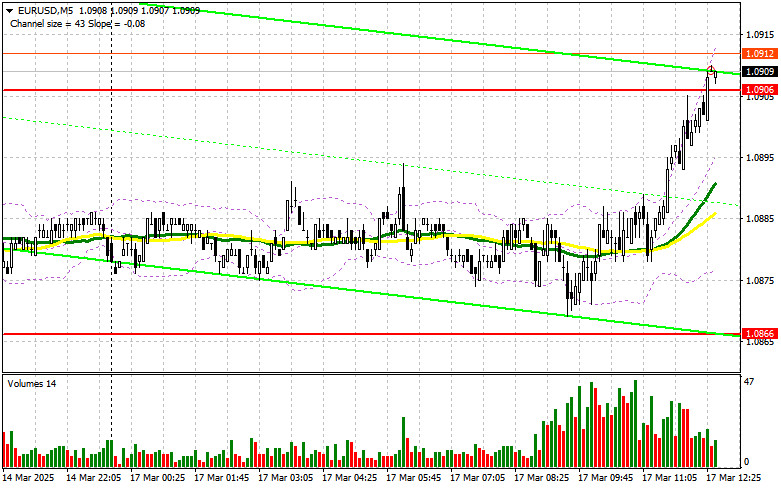

17.03.2025 06:17 PMIn my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions. Let's look at the 5-minute chart to analyze what happened. A decline did occur, but the price fell just short of testing the level by a couple of points, leaving me without a suitable entry point. The technical outlook for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

The absence of economic data from the Eurozone allowed euro buyers to show some activity, but as seen on the chart, the pair failed to generate strong upward momentum. However, the bullish outlook still appears more promising than a corrective decline.

Key upcoming reports include U.S. retail sales, as well as the Empire Manufacturing Index and the NAHB Housing Market Index. If retail sales rise, demand for the dollar will return, as stronger spending could increase inflationary pressure. Given the lackluster market conditions, I prefer to buy the pair on a decline.

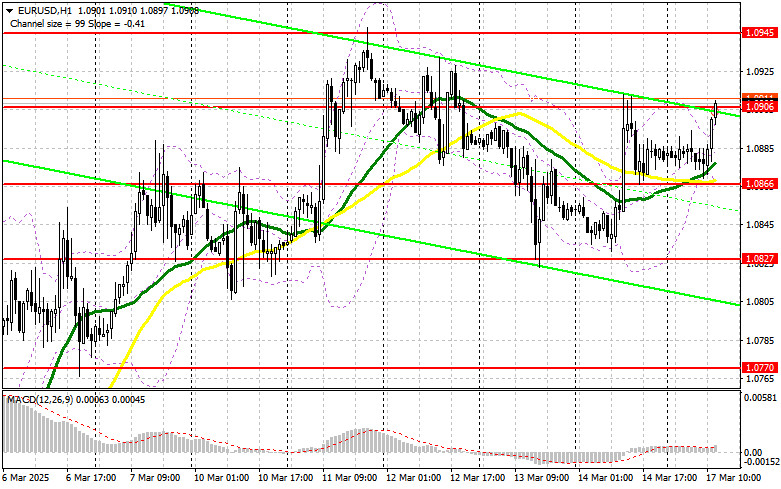

The primary goal for bulls in the second half of the day is to defend the 1.0866 support level. A false breakout at this level would be a buy signal, reinforcing the bullish market structure with a target of 1.0906. A break and a subsequent retest of this level would confirm a valid buy entry, leading to 1.0945, the upper boundary of the sideways channel. The final target would be the 1.0997 high, where I will lock in profits.

If EUR/USD declines and buyers fail to show activity at 1.0866, the pair will likely remain within the range, possibly leading to a minor correction. Sellers could push the pair down to 1.0827. Only after a false breakout at this level would I consider buying the euro. If the pair drops further, I will buy on a rebound from 1.0770, aiming for a 30-35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers have been inactive, and their return to the market depends on strong U.S. retail sales data. A false breakout at 1.0906, combined with positive economic reports, would provide an entry point for short positions, aiming for a correction toward 1.0866, where the 50-day and 30-day moving averages (favoring bulls) are located.

A break and consolidation below this range would offer an additional selling opportunity, targeting 1.0827. The final bearish target is 1.0770, where I will take profits.

If EUR/USD rises in the second half of the day and bears fail to act at 1.0906, buyers may push the pair significantly higher. In that case, I will delay short positions until the next resistance level at 1.0945, where I will sell only after an unsuccessful breakout attempt. I will sell immediately on a rebound from 1.0997, targeting a 30-35 point downward correction.

COT (Commitments of Traders) Report – March 4:

The latest COT report showed a rise in long positions and a significant reduction in short positions, indicating that more traders are willing to buy the euro. Germany's new fiscal stimulus measures have boosted demand for the euro, leading to its strengthening against the U.S. dollar.

The ECB's cautious stance on rate cuts has also supported EUR/USD demand, as reflected in the COT report. The small advantage held by euro sellers is no longer as significant, but buying at current highs still requires caution.

According to the COT data, non-commercial long positions increased by 2,524 to 185,223, while short positions dropped by 12,795 to 195,329. As a result, the gap between long and short positions widened by 3,471.

Indicator Signals:

Moving Averages: Trading is currently taking place near the 30-day and 50-day moving averages, indicating market uncertainty.

Bollinger Bands: If the price declines, the lower Bollinger Band near 1.0866 will act as support.

Indicator Descriptions:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD durante el lunes bajó ligeramente hacia una nueva línea de tendencia alcista, lo que en absoluto interrumpió la tendencia actual. Sí, el lunes pocos esperaban

El par de divisas EUR/USD mostró un movimiento descendente durante el lunes, pero en general se negoció aproximadamente en el mismo rango que en los últimos días. El euro creció

El par de divisas GBP/USD durante el viernes tampoco mostró ningún movimiento interesante. Sin embargo, tampoco comenzó la corrección; la libra mantuvo las posiciones ganadas y conserva una tendencia alcista

El par de divisas EUR/USD durante el viernes se negoció exclusivamente de forma lateral. El trasfondo macroeconómico ese día estuvo ausente, y los traders decidieron salir de fin de semana

El par de divisas GBP/USD durante el miércoles también reanudó su movimiento ascendente, gracias a Donald Trump. Recordemos que ayer Trump impuso aranceles del 25% contra India, pero anteriormente

El par de divisas EUR/USD durante el miércoles reanudó su movimiento ascendente. El contexto macroeconómico ayer estuvo ausente tanto en la Eurozona como en EE.UU., a excepción de un informe

Análisis de las operaciones del martes: Gráfico de 1H del par EUR/USD. El par de divisas EUR/USD continuó moviéndose el martes con una volatilidad mínima y exclusivamente en dirección lateral

GBP/USD: plan para la sesión europea del 5 de agosto. Informes Commitment of Traders COT (análisis de las operaciones de ayer). Los compradores de la libra muestran cada

El par GBP/USD el lunes tampoco mostró ningún movimiento interesante, aunque sí presentó una inclinación alcista mínima. La volatilidad fue nula, por lo que no tuvo sentido operar

El par de divisas EUR/USD se movió exclusivamente de forma lateral el lunes y con una volatilidad mínima. Esperábamos que el mercado continuara procesando los eventos del viernes, pero

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.