Vea también

28.02.2025 09:49 AM

28.02.2025 09:49 AMTrouble never comes alone. The S&P 500 plunged to its lowest levels since mid-January as Donald Trump reignited tariff threats. First, negative economic data from the US, then NVIDIA's earnings report that failed to impress investors, and finally, new import tariffs forced the bulls in US equities to throw in the towel. The fire was further fueled by Tesla's sell-off, with its shares returning to levels last seen during the November presidential elections.

Markets doubt that Elon Musk, who has now taken on the ambitious task of trimming the US government workforce, will have time to focus on his own company. Tesla's sales in Europe plummeted by 45% in January, serving as a catalyst for the stock's nosedive and dragging the S&P 500 down. Meanwhile, Donald Trump appears unlikely to throw a lifeline to the broad stock index.

The US president announced additional 10% tariffs on Chinese imports, sparking outrage in Beijing. Chinese officials have warned that if the US insists on its own course, China will have no choice but to defend its legitimate interests. According to a Harris poll for Bloomberg, 60% of Americans believe tariffs will accelerate inflation, while 44% think they will slow the economy.

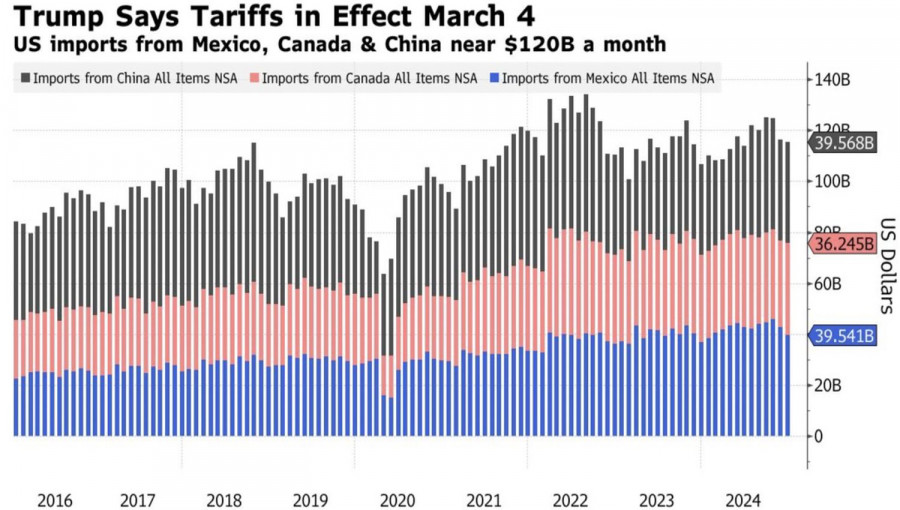

US Imports from China, Mexico, and Canada

US equities face further pressure as Trump plans to introduce 25% tariffs on imports from Mexico and Canada starting in March. The close ties between US companies and their North American neighbors risk disrupting supply chains, increasing stagflation risks, and potentially triggering a recession. These concerns, combined with other bearish factors, have made individual investors the most pessimistic about the S&P 500's outlook in recent history. According to the American Association of Individual Investors (AAII) survey, the share of bearish sentiment surged from 40.5% to 61% in just one week, marking the highest level since September 2022.

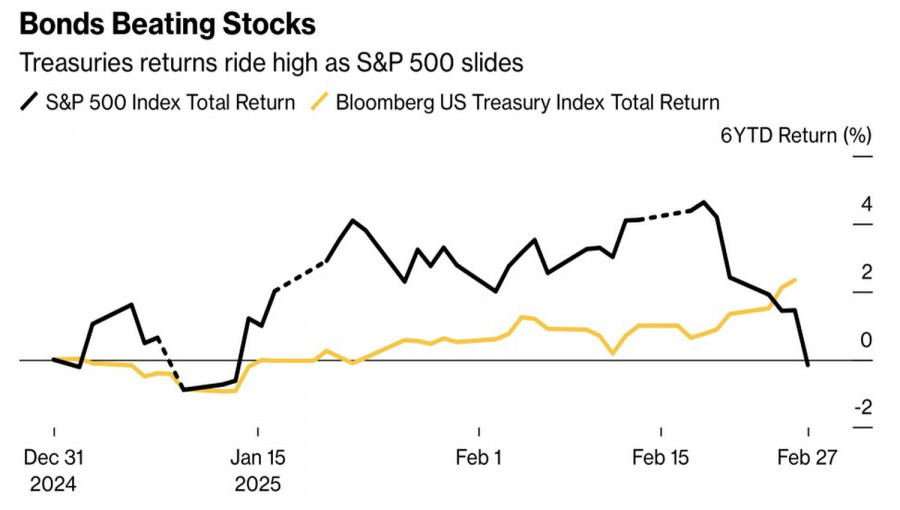

Money continues to flee the US stock market, especially since alternative opportunities abound. Delays in tariffs have fueled rallies in European and Chinese stock indices. Meanwhile, the AI hype is no longer enough to sustain investor interest in US tech giants, given rising competition from abroad. Finally, as the S&P 500 tumbles, rising US Treasury prices provide an attractive domestic alternative for capital allocation.

US equity and bond yield trends

Capital flight is a major blow to the broad market index. There's hope that Trump's tariff threats won't materialize, but for now, investors are poised to play safe.

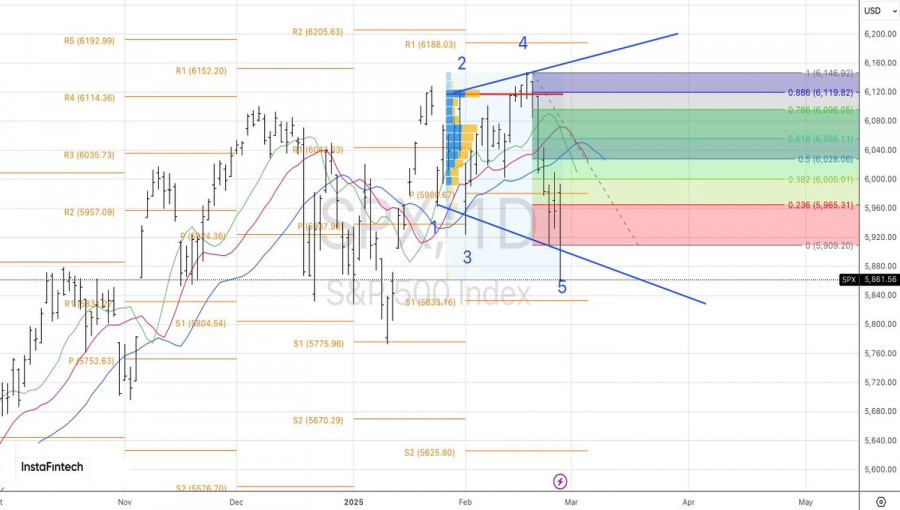

From a technical standpoint, the S&P 500 continues to develop a Broadening Wedge pattern on the daily chart. The short positions initiated at 6,083 and reinforced at 6,000 should be maintained, especially since the first of the two previously mentioned targets at 5,830 and 5,750 is now within reach.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

El par de divisas EUR/USD continuó su recuperación durante el miércoles en un contexto de calendario macroeconómico absolutamente vacío. Ni siquiera destacamos el único informe del día sobre la inflación

El lunes, la moneda estadounidense se fortaleció considerablemente tras el éxito en la primera ronda de negociaciones entre EE. UU. y China, aunque, en esencia, ambas partes solo acordaron

El par de divisas EUR/USD estuvo prácticamente todo el martes en una tendencia alcista. Uno se acostumbra rápido a lo bueno, y el mercado claramente esperaba una continuación del fortalecimiento

El par de divisas GBP/USD también cayó rápida y alegremente el lunes. EE. UU., representado por el Secretario del Tesoro Scott Bessent, anunció el primer avance en las negociaciones

El par de divisas EUR/USD cayó el lunes como una piedra. ¿Adivinan a quién hay que agradecerle esto? Por supuesto, a Donald Trump. Aunque esta vez, solo de forma indirecta

El par de divisas EUR/USD continuó negociándose el jueves dentro del mismo canal lateral, claramente visible en el marco temporal de una hora, prácticamente hasta la noche. Tras la reunión

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.