AUDMXN (Australian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

17 Jun 2025 00:41

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/MXN is not a very popular currency pair on Forex. AUD/MXN represents the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/MXN price charts, you can get and approximate AUD/MXN chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that AUD and MXN could respond differently towards changes in the U.S. economy, therefore, the AUD/MXN currency pair may be a specific indicator reflecting changes within the two currencies.

To date, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector, due to mass privatization of state enterprises mostly in the 80s of last century to overcome the economic crisis. For the most part the former state-owned enterprises in Mexico are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, this country has an active trade with its rich neighbors - the United States and Canada, which is a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. Currently most of the country’s revenues are generated in the oil sector. However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to the forecasts, with such a policy, Mexico will soon be forced to import oil from abroad, to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed in global financial markets. In addition, the Mexican peso exchange rate is highly dependent on international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

This trading instrument is relatively illiquid compared it with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this financial instrument, focus primarily on those currency pairs that include a U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

6838

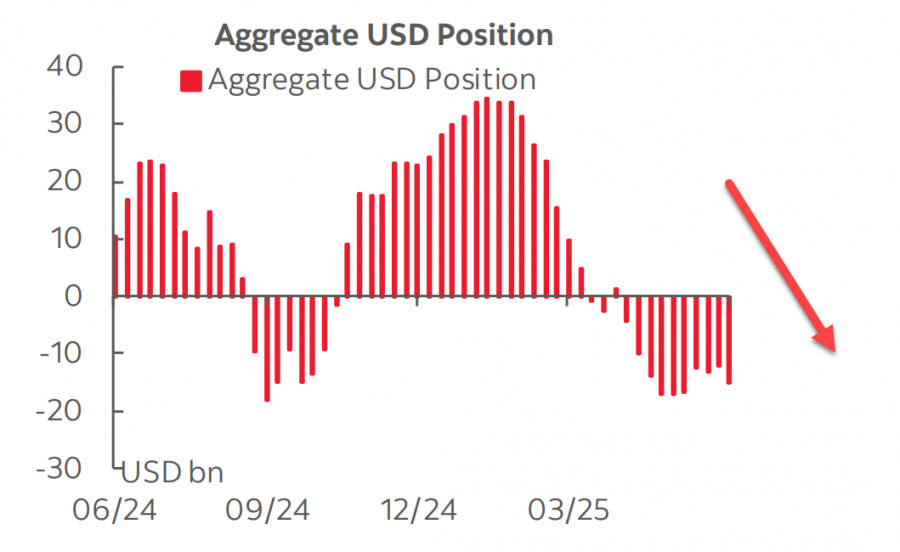

Fundamental analysisCFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1693

Fundamental analysisThe Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1648

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1648

Bears still struggling to find supportAuthor: Samir Klishi

12:02 2025-06-16 UTC+2

1618

Stock Market on May 16th: S&P 500 and NASDAQ Closed LowerAuthor: Jakub Novak

10:43 2025-06-16 UTC+2

1498

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1468

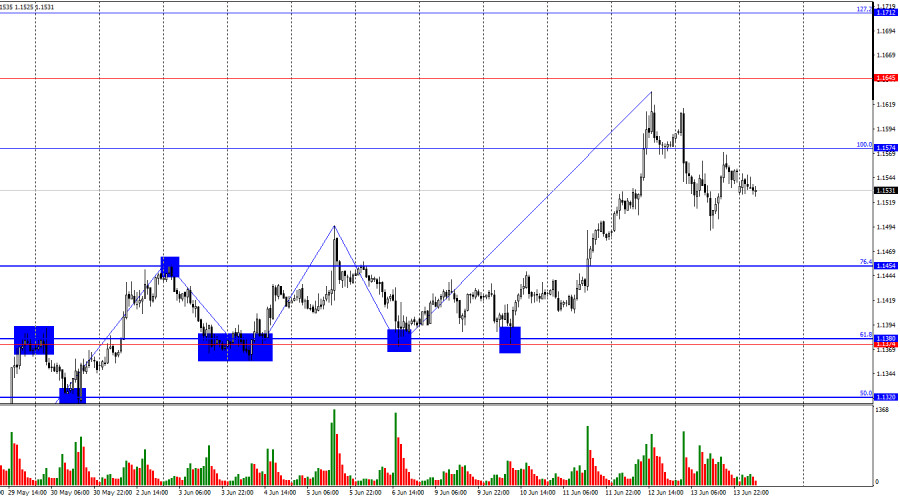

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

12:08 2025-06-16 UTC+2

1378

Bitcoin pauses above $105,000, but breakout occursAuthor: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

1243

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

6838

- Fundamental analysis

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1693

- Fundamental analysis

The Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1648

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1648

- Bears still struggling to find support

Author: Samir Klishi

12:02 2025-06-16 UTC+2

1618

- Stock Market on May 16th: S&P 500 and NASDAQ Closed Lower

Author: Jakub Novak

10:43 2025-06-16 UTC+2

1498

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1468

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

12:08 2025-06-16 UTC+2

1378

- Bitcoin pauses above $105,000, but breakout occurs

Author: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

1243