Veja também

17.03.2025 09:03 AM

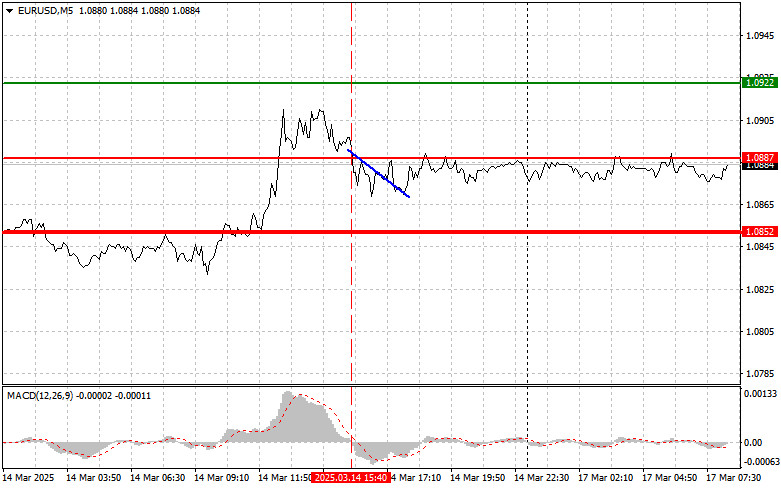

17.03.2025 09:03 AMThe price test at 1.0887 occurred when the MACD indicator had just started moving downward from the zero mark, confirming the correct entry point for selling the euro. As a result, the pair fell by only 20 pips before the selling pressure eased.

The news that the U.S. Senate, following the House of Representatives, approved an extension of government funding until the end of September this year did not trigger a surge in volatility. This indicates that market participants had already priced in this outcome. Now, the focus will shift to the Federal Reserve's future actions and signals from other central banks regarding monetary policy. Geopolitical risks and global economic growth prospects also influence investor sentiment, counteracting the short-term positive effect of the U.S. lawmakers' decision.

Today's economic calendar in the first half of the day includes only the publication of the Bundesbank's monthly report. This document often contains important details about Germany's economic climate and outlook. Analysts and investors pay close attention to the Bundesbank's comments on inflation, interest rates, consumer demand, and industrial production. Specifically, the report could provide insights into the likely future direction of the European Central Bank's monetary policy.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Scenario #1: Today, I will consider buying the euro if the price reaches around 1.0895 (green line on the chart), aiming for growth towards 1.0937. At 1.0937, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. The euro's growth in the first half of the day is expected to continue the upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and has just started rising.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0873 price level while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth to the opposite levels of 1.0895 and 1.0937 can be expected.

Scenario #1: I plan to sell the euro after it reaches the 1.0873 level (red line on the chart), targeting a decline to 1.0833, where I intend to exit the market and immediately buy in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Selling pressure on the pair could return today if the German bank's report is weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and has just started moving downward from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0895 price level while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline to the opposite levels of 1.0873 and 1.0833 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O teste do nível de preço em 143,75 na primeira metade do dia ocorreu justamente quando o indicador MACD já havia se afastado significativamente da linha zero, o que limitou

O teste de preço em 1,1441 coincidiu com o momento em que o indicador MACD começou a subir a partir da linha zero, confirmando o ponto de entrada ideal para

Petróleo de volta aos holofotes Os contratos futuros do Brent ultrapassaram a marca de US$ 67,5 por barril nesta quarta-feira, atingindo o maior nível em oito semanas. Vários fatores contribuíram

O teste do nível de 1,1440 ocorreu quando o indicador MACD já havia subido significativamente acima da linha zero, limitando o potencial de alta do par. Por esse motivo

O teste do nível de 144,21 ocorreu quando o indicador MACD começou a subir a partir da linha zero. Isso confirmou um ponto de entrada válido para a compra

O teste do nível de 1,3562 na segunda metade do dia coincidiu com o início do movimento de queda do indicador MACD a partir da linha zero, o que confirmou

O teste de preço em 1,1420 ocorreu exatamente quando o indicador MACD começou a se mover para baixo a partir da marca zero, confirmando um ponto de entrada válido para

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.