Veja também

27.12.2024 12:33 AM

27.12.2024 12:33 AMThe Canadian dollar is concluding the year on a pessimistic note, with little opportunity for reversing its weakening trend.

Preliminary data revealed that Canada's GDP contracted by 0.1% in November, following a 0.3% growth in the previous month. This marks the first negative reading of the year, and December growth is also expected to be weak. Annual growth is projected to be 1.7%, which is below the Bank of Canada's forecast of 2%.

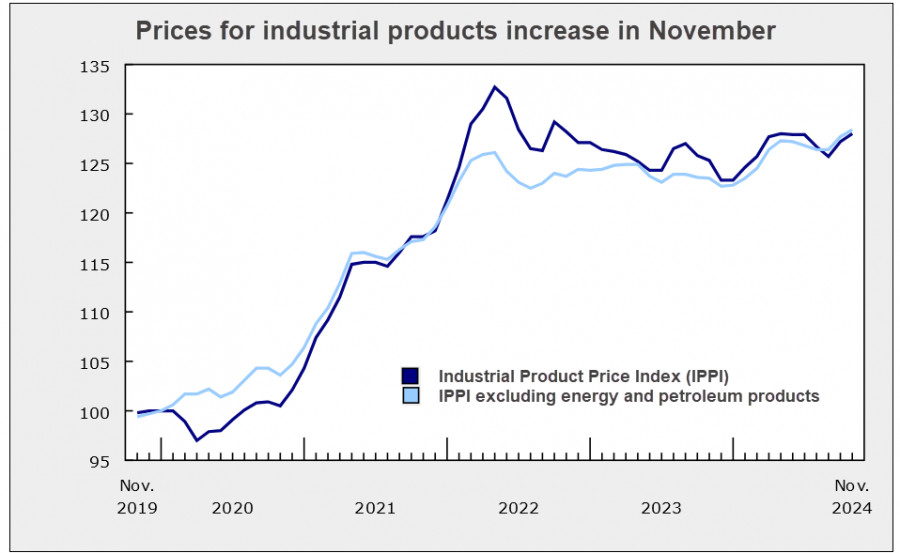

Additionally, the Industrial Product Price Index increased by 0.6% in November, reaching an annual rate of 2.2%. This indicates that commodity prices are rising more quickly than consumer prices, which does not significantly help to boost confidence in controlling inflation.

The Bank of Canada anticipated that economic growth would accelerate once inflation fell within the target range of below 3%. To facilitate this, the Bank aggressively cut interest rates starting in June, reducing the policy rate by 175 basis points from a peak of 5% to 3.25%. However, the economy has been sluggish in its response and continues to slow down. Additional rate cuts may be necessary to stimulate growth, but they can only occur if inflation is firmly under control. At present, there is a lack of confidence in this outcome—headline inflation dropped to 1.6% in September but rose slightly to 2.0% in October and 1.9% in November. Aggressive rate cuts could risk reigniting inflation, a scenario that the Bank of Canada cannot afford.

Currently, the rate forecast suggests a pause in January to evaluate the year's results, followed by a resumption of rate cuts down to 2.25% by the end of 2025. This indicates an additional 100 basis points of easing from the current level, which is already below the Federal Reserve's rate. Meanwhile, the markets expect only one 25-basis-point cut from the Fed. Consequently, yield expectations clearly favor the U.S. dollar, widening the yield spread and contributing to further weakening of the Canadian dollar.

U.S. President-elect Donald Trump quickly announced plans to revise tariff policies with several countries, specifically targeting China, Canada, and Mexico, the top three suppliers of goods to the U.S. On Wednesday, Trump mentioned Canada again, this time alongside Greenland and the Panama Canal, jokingly suggesting that the U.S. might take control of them. In a lighthearted tone, he predicted that Canada could become the 51st U.S. state. While these statements are not direct threats, they highlight the need for Canadian Prime Minister Justin Trudeau's government to take U.S. tariff policy seriously and consider making concessions rather than planning retaliatory measures. These remarks do little to inspire confidence among Canadian investors.

Canada is on the verge of a political crisis. According to Polymarket, there is a 42% chance that Prime Minister Trudeau will step down by February, with that probability rising to 74% by April. Many believe Trudeau lacks the strength to effectively advocate for Canada's interests in negotiations with Trump.

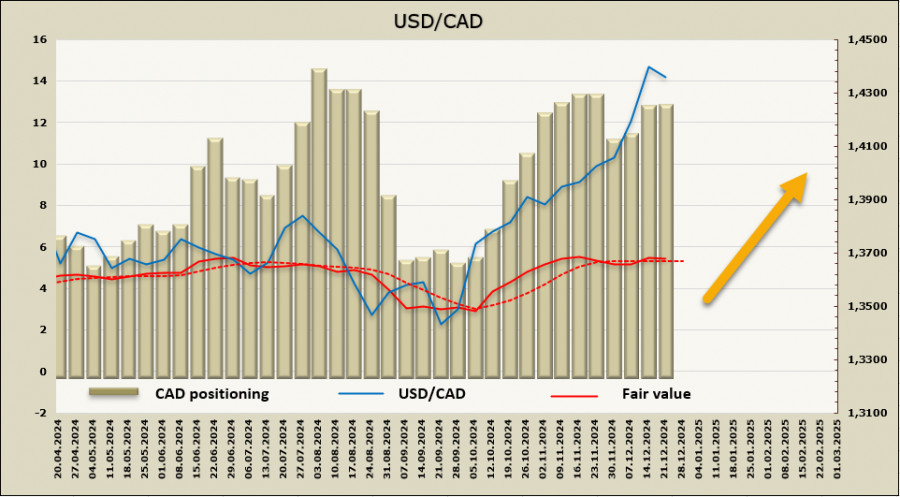

Speculative positioning on the Canadian dollar (CAD) remained largely unchanged over the past week, maintaining a strong bullish outlook. Although the calculated price has lost some momentum, it still remains above the long-term average.

As expected last week, the USD/CAD pair experienced a slight correction from its high on December 19. This adjustment appears to be a technical response to being in overbought territory. There isn't much justification for a more significant correction at this time. Support is identified at the 1.4210/20 levels, but it is unlikely that the pair will reach this zone. The target remains the local peak from March 2020, which is 1.4667.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

A próxima semana não deve trazer grandes eventos nem manchetes dramáticas — nenhuma nova promessa de Donald Trump para abalar os mercados. No entanto, ainda haverá fatores relevantes a serem

Os mercados já precificaram completamente o resultado das negociações entre os EUA e a China, que culminaram em uma trégua comercial de 90 dias. Dados econômicos mais fracos

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.