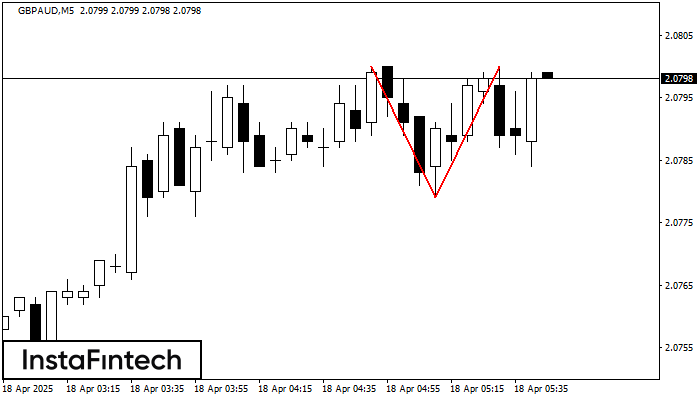

Double Top

was formed on 18.04 at 04:45:09 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on GBPAUD M5. Characteristics: the upper boundary 2.0800; the lower boundary 2.0779; the width of the pattern is 21 points. Sell trades are better to be opened below the lower boundary 2.0779 with a possible movements towards the 2.0764 level.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Inverse Head and Shoulder

was formed on 10.06 at 09:44:57 (UTC+0)

signal strength 2 of 5

According to M15, EURNZD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 1.8889/1.8887 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

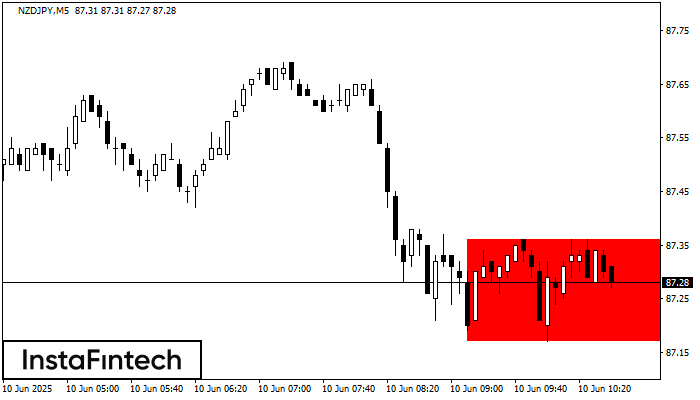

Bearish Rectangle

was formed on 10.06 at 09:42:43 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDJPY formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 87.36 - 0.00

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

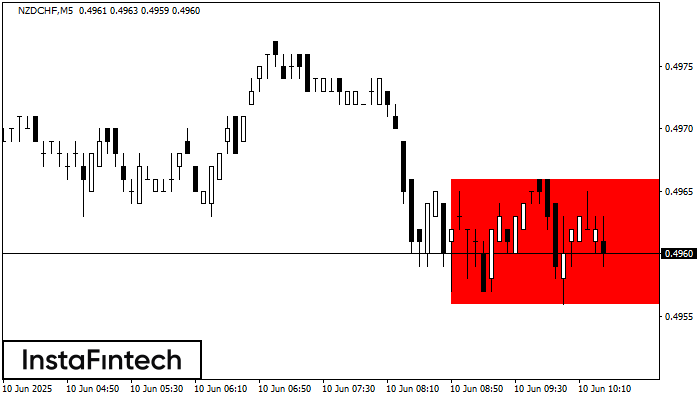

Bearish Rectangle

was formed on 10.06 at 09:29:41 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 0.4966, the lower border is 0.4956. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window