Seven most magnificent palaces in the world

The prestigious magazine Architectural Digest has published a ranking of the world's most beautiful palaces. Let us take a look at the buildings that topped this list

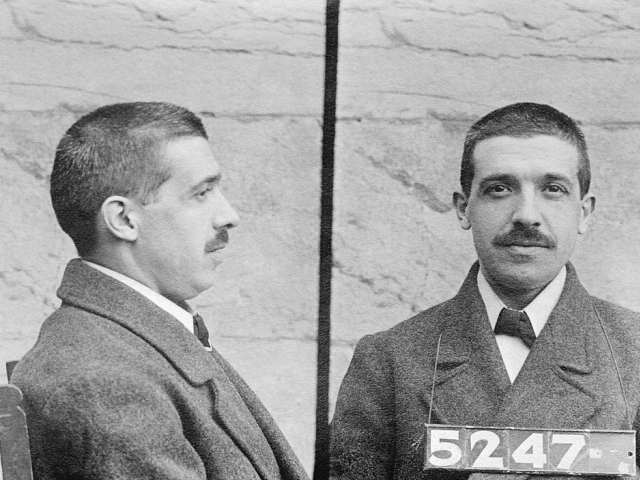

1. Charles Ponzi (Securities Exchange Company)

Loss: about $20 million

Type of fraud: pyramid scheme

The Securities Exchange Company was engaged in arbitration transactions. In the debt receipts issued by the company, it was obliged to double every $1000-1500 received in 90 days.

In the summer of 1920, one of the investors, Daniels, demanded 50% of the profits from the Ponzi's company. Under the laws of that time, such a lawsuit allowed freezing the funds of Ponzi which were kept on the accounts in banks. On July 26 Ponzi announced a temporary suspension of accepting deposits in connection with tax inspections. It was a mistake, investors began to take money out. So the pyramid collapsed, Ponzi was detained in connection with the identified debt of $7 million, with funds in the accounts of only 4 million.

In October of the same year, Ponzi was sentenced to five years in prison.

2. Bernard Ebbers (WORLDCOM)

Loss: $100 billion

Type of fraud: false financial reporting

The founder of the WorldCom telecommunications company, Bernie Ebbers, was once considered one of the US brightest businessmen. At first, he was one of the investors, and then he became a chief executive officer, on the persuasions of friends.

The crisis came in June 2002, when the new leadership of WorldCom admitted that the data on profits in 2001 and in the first quarter of 2002 were overstated by $3.9 billion (the number eventually grew to $11 billion).

This served as a starting point for a series of investigations and proceedings that focused on Ebbers. He was convicted of fraud and complicity in the crime as a result of false financial reporting by WorldCom.

3. Jordan Belfort (STRATTON OAKMONT)

Loss: $200 million

Type of fraud: stock-market manipulation

The Belfort's brokerage firm, founded in the 1990s, was engaged in the sale of cheap shares by phone urging investors to enter fraudulent transactions. The company's staff consisted of more than a thousand employees who conducted financial transactions with a total turnover of more than one billion dollars including the IPO of the Steve Madden's shoe company.

In 1998, Belfort was convicted of fraud and money laundering. He cooperated with the FBI and was sentenced to 22 months in prison. He also was obliged to pay back $110.4 million, which he fraudulently obtained from his clients.

The story of Belfort inspired the eminent director, Scorsese, to make the film "The Wolf from Wall Street."

4. James Paul Lewis Jr. (FINANCIAL ADVISORY CONSULTANTS)

Loss: $311 million

Type of fraud: pyramid scheme

James Paul Lewis Jr. operated one of the largest and longest-running Ponzi schemes in United States history.

Over approximately 20 years, Lewis collected around $311 million U.S. dollars from investors whom he promised high returns. Lewis said that he was investing the money but was instead using it to finance his own high lifestyle of fancy cars, big homes, and girlfriends.

The ploy Lewis was running was a classic "Ponzi scheme"; in this scheme, new investors contribute funds that get redistributed to earlier investors (including Lewis himself).

In 2006, Lewis received 30 years in prison for money laundering and a fine of $156 million.

5. Michael de Guzman (BRE-X MINERALS)

Loss: $3 billion

Type of fraud: false data on gold reserves

In 1993 Michael de Guzman announced to the public about the new gold deposit at Busang. The reserves of this precious metal were estimated at 30 million ounces, then 70 million, and then 200 million ounces.

According to some estimates, the deposit had 3-4% of the world's gold reserves. The company's price rose from $1 billion to $6 billion over three years. The company formed a partnership with Freeport-McMoRan which insisted on conducting a new audit and re-checking all data. The results were stunned: Busang was not at all a deposit, and there was no gold there. The company's shares were devalued to zero, and the main geologist, under strange circumstances, dropped out of the helicopter a week before the end of the inspection.

6. Samuel Israel III (BAYOU HEDGE FUND GROUP)

Loss: $350 million

Type of fraud: guaranteed unrealistic incomes

Samuel Israel III worked as the executive director of the very prosperous Bayou Hedge Fund Group. By 2005, the Fund had accumulated more than $2 billion. Meanwhile, Bayou did not have any real income.

In the machinations, the classical scheme of the pyramid was used: Israel covered debts to investors who had come earlier through the contributions of new investors.

When this pyramid burst, the losses of credulous investors amounted to several hundred million dollars.

The court found Israel guilty of causing damage estimated at $350 million. He was sentenced to 20 years in prison and paid a fine of $200 million.

7. Joseph Nacchio (QWEST COMMUNICATIONS INTERNATIONAL)

Loss: $3 billion

Type of fraud: insider trading

Ex-president of the US Qwest telecommunications company Joseph Nacchio sold the company's shares for about $50 million after he received confidential information that the company will not be able to achieve the established financial goals.

On April 20, 2007, Nacchio was convicted of 19 counts of insider trading and sentenced to 6 years in prison.

8. Barry Minkow (ZZZZ BEST INC.)

Loss: $100 million

Type of fraud: pyramid scheme

In 1987, when Barry turned 20 years old, the capitalization of his company ZZZZ Best amounted to $280 million, and the value of the Minkow's package was estimated at $100 million.

The entrepreneur gave lectures about his unprecedented success, visited the Oprah Winfrey show as a guest, and wrote books.

In 1988, journalists found out that Minkow's company does not actually exist, and that he forged several tens of thousands of documents to enter an IPO.

Barry Minkow was sentenced to 25 years in prison and fined $26 million.

9. Kenneth Lay and Jeffrey Skilling (ENRON)

Loss: $74 billion

Type of fraud: falsification of financial data

Skilling was convicted on 35 counts of securities fraud related to the collapse of the Enron company. He did not admit his guilt for any of them. But the prosecutor managed to prove the fact that Skilling sold Enron shares for a total of $60 million after leaving the corporation.

Of course, the representatives of the prosecution said that Jeffrey knew about the imminent bankruptcy of the company and used this knowledge contrary to all the laws on currency transactions.

Skilling was sentenced to 24 years in prison and fined of $45 million.

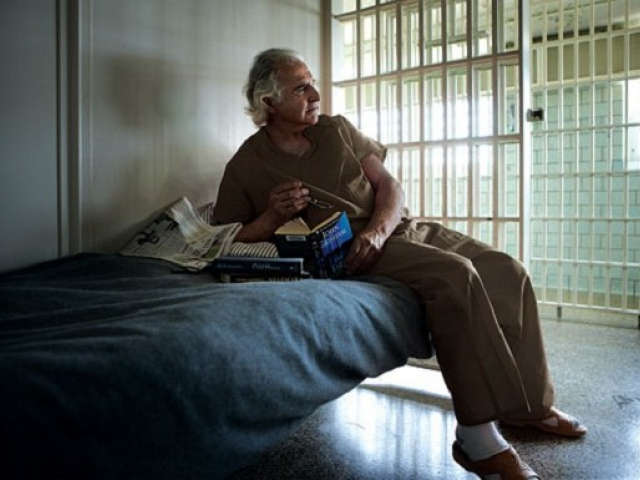

10. Bernie Madoff (BERNARD L. MADOFF INVESTMENTS SECURITIES LLC)

Loss: $65 billion

Type of fraud: pyramid scheme

Bernard Madoff, according to preliminary estimates of experts, is the operator of the largest financial fraud in history which affected one to three million people and several hundred financial organizations. The damage is estimated at as much as $64.8 billion.

On December 10, 2008, Madoff, as the media say, told his sons Andrew and Mark that his business was a massive Ponzi scheme and "one big lie". Sons handed this information to the authorities. And the next day the Federal Bureau began an investigation. The accounts of Madoff were frozen, he himself was arrested. It turned out that Madoff Securities did not invest in trusted funds at least for the past 13 years.

In the period of the global financial crisis aggravation, in November-December 2008, several large investors wanted to return the invested funds or other property worth $7 billion, but Madoff had nothing to pay, the pyramid burst.

The debt of the company was approximately $50 billion. Some doubt that he acted alone, and insist on finding accomplices.

The US authorities believe that the Madoff's fund has not conducted a single transaction on the exchange for the entire period of its existence.

For his financial fraud, Madoff received 150 years in prison and was fined $170 billion.

The prestigious magazine Architectural Digest has published a ranking of the world's most beautiful palaces. Let us take a look at the buildings that topped this list

Winter is the perfect time to curl up in a warm blanket and enjoy drinks that bring coziness and holiday cheer. Here are seven winter drinks that are perfect for cold days

Despite the widespread belief that ultra-wealthy individuals are leaving big cities in search of privacy, most still prefer to live in bustling metropolises, according to the latest billionaire census conducted by Altrata. Let's explore which cities today have the largest concentration of people with a fortune exceeding $1 billion