Lihat juga

01.04.2025 10:58 AM

01.04.2025 10:58 AMTrade Review and Trading Tips for the Japanese Yen

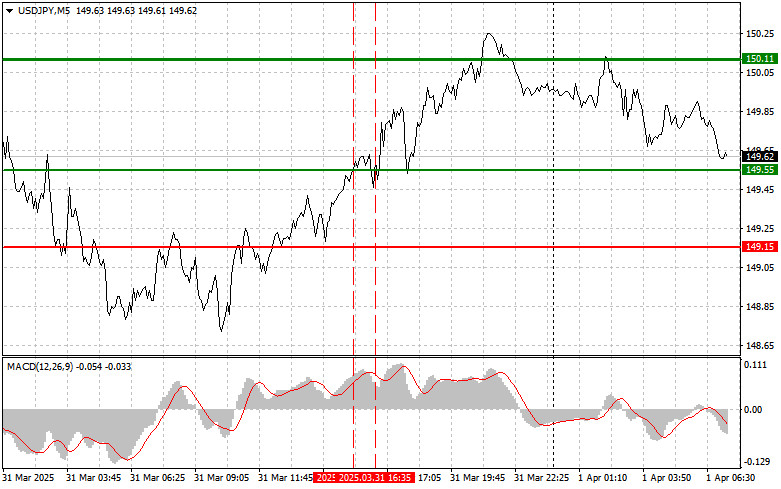

The test of the 149.55 level occurred at a moment when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For that reason, I didn't buy the dollar. Shortly after, another test of the 149.55 level with the MACD in the overbought zone led to the implementation of Scenario #2 for selling, which resulted in a loss since the pair failed to decline.

Today's strong data on Japan's Large Manufacturers Index, Non-Manufacturing Activity Index, and the Tankan Index for capital expenditures of large enterprises led to yen strengthening and a decline in the U.S. dollar. Notably, the large manufacturers' index showed steady growth, indicating recovery in manufacturing capacity and rising order volumes. The non-manufacturing index also exceeded expectations, reflecting expansion in the services sector and improved consumer confidence.

Special attention was paid to the Tankan Index for capital expenditures by large enterprises, which reflects companies' intentions to invest in production development and modernization. The positive reading signals long-term optimism among Japanese businesses and confidence in future economic growth.

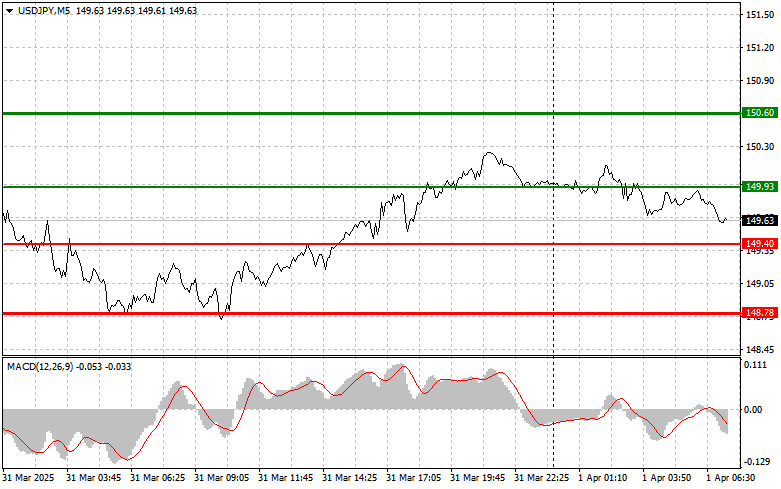

As for the intraday strategy, I will continue to rely primarily on Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy USD/JPY today at the entry point around 149.93 (green line on the chart), targeting a rise to 150.60 (thicker green line on the chart). Around 150.60, I will exit long positions and open short ones in the opposite direction (aiming for a 30–35 point reversal). It's best to buy the pair during pullbacks or significant dips in USD/JPY. Important: Before buying, make sure the MACD is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if the price tests 149.40 twice in a row while the MACD is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. A rise to the opposite levels of 149.93 and 150.60 can be expected.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY today only after breaking below the 149.40 level (red line on the chart), which should lead to a rapid decline. The key target for sellers will be 148.78, where I'll exit short positions and immediately open long ones (targeting a 20–25 point bounce). Downward pressure on the pair can return at any moment. Important: Before selling, make sure the MACD is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today if the price tests 149.93 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 149.40 and 148.78 can be expected.

Chart Key:

Important: Beginner traders in the forex market must be extremely cautious when making entry decisions. It is best to stay out of the market ahead of key fundamental releases to avoid sudden price swings. If you choose to trade during news events, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember, successful trading requires a clear trading plan—like the one I've outlined above. Making impulsive trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Ujian harga pada 147.72 bertepatan dengan penunjuk MACD yang mula bergerak ke bawah dari tanda sifar, mengesahkan titik masuk yang sah untuk menjual dolar dan mengakibatkan penurunan lebih daripada

Ujian harga pada 1.3393 bertepatan dengan penunjuk MACD baru saja mula bergerak ke atas dari tanda sifar, mengesahkan titik masuk yang sah untuk membeli pound. Akibatnya, pasangan ini meningkat lebih

Ujian harga pada 1.1483 sejajar dengan pergerakan menaik penunjuk MACD dari tanda sifar, mengesahkan titik masuk yang sah untuk membeli euro. Akibatnya, pasangan mata wang meningkat ke arah tahap sasaran

Pagi ini, euro mungkin meneruskan pergerakan menaik, namun data yang kukuh perlu dikeluarkan untuk menyokong kenaikan tersebut. Data yang dijangka akan diterbitkan termasuk Indeks Iklim Perniagaan IFO Jerman, Penunjuk Penilaian

Analisis dan Petua Dagangan untuk Yen Jepun Ujian paras 147.48 berlaku apabila penunjuk MACD berada dalam zon terlebih beli, menyebabkan senario #1 untuk membeli dolar dalam aliran menaik semasa tidak

Analisis dan Petua Dagangan untuk Pound British Ujian harga pada paras 1.3420 pada separuh pertama hari ini berlaku serentak dengan penunjuk MACD yang baru mula bergerak menurun dari garisan sifar

Analisis dan Petua Dagangan untuk Euro Ujian harga pada paras 1.1499 berlaku serentak dengan penunjuk MACD yang mula bergerak menurun dari garisan sifar. Ini membolehkan senario jualan euro dilaksanakan, yang

Analisis dan Petua Dagangan bagi Yen Jepun Ujian paras 145.67 berlaku apabila penunjuk MACD telah pun bergerak jauh di atas garisan sifar, yang mengehadkan potensi penurunan pasangan mata wang

Analisis dan Petua Dagangan untuk Pound British Ujian paras 1.3483 bertepatan apabila penunjuk MACD baru mula bergerak menurun dari garis sifar, sekali gus mengesahkan titik kemasukan yang sah untuk menjual

Analisis dan Petua Dagangan untuk Euro Ujian paras harga 1.1510 berlaku serentak apabila penunjuk MACD baru mula bergerak menurun dari garisan sifar, sekali gus mengesahkan titik kemasukan yang sah untuk

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.