Lihat juga

31.03.2025 03:21 AM

31.03.2025 03:21 AMOn Friday, the EUR/USD currency pair once again traded higher. We can't say that macroeconomic events justified this movement. At this point, it's unsurprising that the dollar could drop at any moment. As a reminder, the U.S. currency remains under heavy pressure from Donald Trump. On Thursday, he implemented new tariffs, which resulted in another decline in the dollar's value. On Friday, however, the unemployment rate in Germany rose, and the number of unemployed increased more than forecast. These two reports alone should have triggered a decline in the euro. In addition, the PCE index — a proxy for inflation — rose more than expected, which implies a higher probability of a hawkish stance from the Federal Reserve throughout 2025. So, the dollar should have strengthened, not weakened. Only the University of Michigan Consumer Sentiment Index came in significantly weaker than forecast — and it was released after the dollar had already started to fall.

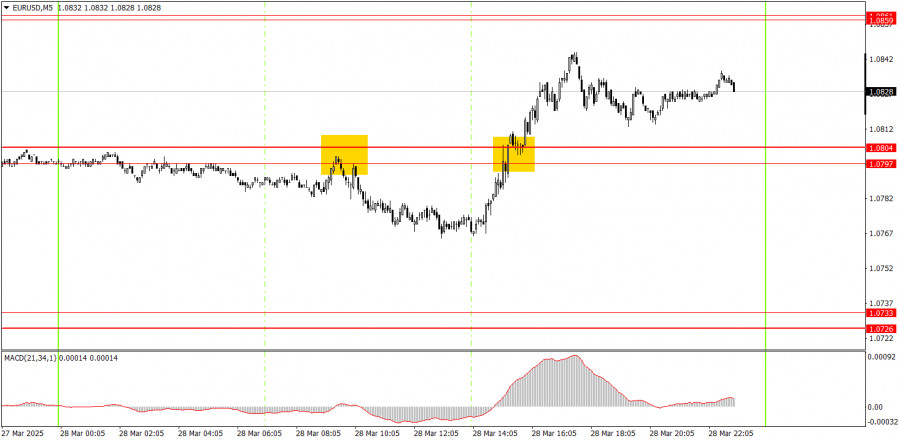

On the 5-minute timeframe, two trading signals were formed on Friday. First, the pair bounced off the 1.0797–1.0804 area and dropped 20 pips. It's unlikely traders profited much from this trade — if at all. Then, the price broke above this area and increased by about 30 pips. This second trade could yield a modest profit of 10–15 pips, as the price remained above the 1.0797–1.0804 zone until the end of the session.

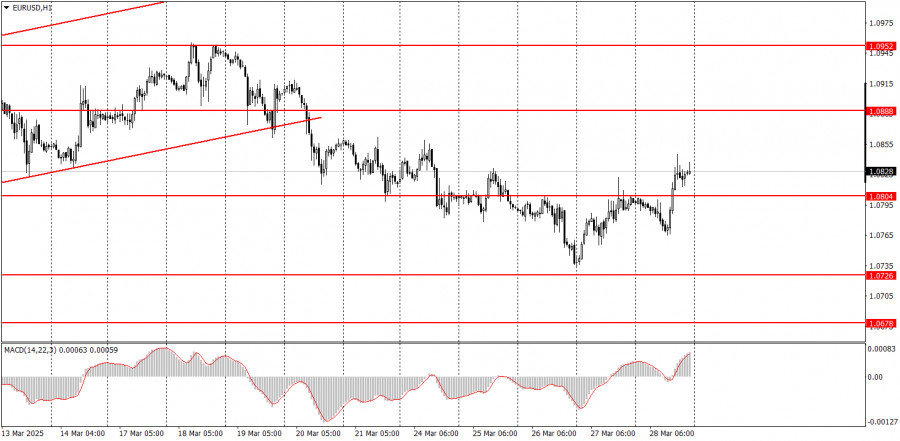

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of that trend resuming are decreasing. Since the fundamental and macroeconomic backdrop still favors the U.S. dollar more than the euro, we continue to expect a decline. However, Donald Trump keeps dragging the dollar down with his ongoing tariff decisions and statements about reshaping the global order in the U.S.'s favor. Politics and geopolitics currently overshadow fundamentals and macroeconomics, so we don't expect strong dollar growth.

On Monday, the euro could resume its decline, as a downtrend has begun on the hourly chart. The dollar is oversold and has depreciated too much and too unjustifiably lately. Continuing the correction is possible — but Donald Trump is still around...

On the 5-minute chart, the following levels should be monitored: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048. Germany will release retail sales and March inflation data on Monday — interesting reports, although not the most critical ones. The U.S. economic calendar is empty.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada hari Selasa, pasangan GBP/USD berdagang dengan kecenderungan menurun, yang dibenarkan oleh beberapa faktor. Pertama, pasangan ini mengukuh di bawah garis aliran menaik. Kami tidak percaya bahawa satu aliran menurun

Analisis Dagangan Hari Selasa Carta 1-Jam Pasangan EUR/USD Pada hari Selasa, pasangan mata wang EUR/USD sekali lagi tidak menunjukkan sebarang kecenderungan untuk berdagang secara aktif. Sepanjang tiga hari yang lalu

Pada hari Selasa, pasangan mata wang GBP/USD meneruskan dagangan dengan agak tidak teratur tetapi dengan nada penurunan. Pound British sekurang-kurangnya menunjukkan sedikit penurunan selepas aliran berubah ke arah bawah. Ingat

Analisis EUR/USD carta 5-Minit Pasangan mata wang EUR/USD terus bergerak dalam kedua-dua arah sepanjang hari Selasa. Pergerakan ini menunjukkan pasaran dalam keadaan mendatar. Mari kita ingat bahawa sebelum ini, pasangan

Dalam ramalan pagi saya, saya memberi perhatian kepada tahap 1.3545 dan merancang untuk membuat keputusan memasuki pasaran berdasarkan tahap ini. Mari kita lihat pada carta 5 minit untuk melihat

Dalam ramalan pagi, saya menekankan tahap 1.1388 dan merancang untuk membuat keputusan penyertaan pasaran berdasarkan tahap tersebut. Mari kita lihat carta 5 minit untuk melihat apa yang berlaku. Penurunan

Analisis Dagangan Hari Isnin Carta 1 Jam pasangan GBP/USD Pasangan GBP/USD turut didagangkan dalam kedua-dua arah pada hari Isnin. Pada hari Jumaat, harga telah menetap di bawah garisan arah aliran

Pasangan mata wang EUR/USD didagangkan dengan volatiliti rendah dan dalam kedua-dua arah pada hari Isnin. Pada hari tersebut, latar belakang makroekonomi hampir tiada, menyebabkan pedagang kekurangan perkara untuk diambil tindakan

Analisis GBP/USD carta 5 Minit Pada hari Isnin, pasangan mata wang GBP/USD secara dijangka gagal untuk meneruskan pergerakan menurunnya. Perlu diingatkan bahawa sebelum ini, harga sekali lagi membentuk isyarat untuk

Pada hari Isnin, pasangan mata wang EUR/USD didagangkan secara bercampur. Walaupun telah melepasi garisan arah aliran, pergerakan ke bawah (iaitu pengukuhan dolar AS) tidak benar-benar bermula. Oleh itu, isyarat teknikal

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.