Lihat juga

17.03.2025 10:15 AM

17.03.2025 10:15 AMGlobal financial markets continue to be heavily influenced by the policies of the U.S. president, who is disrupting the established economic and geopolitical framework that existed before him. Naturally, this is affecting the markets. Despite this, market participants are trying to anticipate future developments by closely monitoring incoming economic data and decisions from the Federal Reserve.

This week, investors will be focused on the outcome of the Fed meeting. While no changes to interest rates are expected, close attention will be paid to the final resolution and, most importantly, Fed Chair Jerome Powell's speech at the press conference.

The week ahead is packed with key events. Crucial data on retail sales, industrial production, and housing market indicators will be released, such as building permits and existing home sales. Additionally, monetary policy meetings will take place at the central banks of Japan, China, the UK, and Switzerland. Inflation reports from Canada and Japan will be published, while China's statistics agency will provide data on retail sales, industrial production, housing price indexes, and fixed asset investments. In Europe, attention will be on employment figures, the UK's GFK consumer confidence index, Germany's economic sentiment indicator, New Zealand's GDP growth rate, and Canada's retail sales figures.

So, what do market participants expect from the Federal Open Market Committee (FOMC) meeting? The Fed is anticipated to maintain its key interest rate within the 4.25%–4.50% range, continuing the pause in the rate-cutting cycle that began in January this year. Fed officials will likely adopt a cautious stance due to the ongoing economic uncertainty driven by Donald Trump's policies.

How might this affect the markets?

As I have previously noted, market participants are hesitant to fully commit to financial assets given the current uncertainty surrounding the consequences of Trump's policies. The real risk of a localized collapse in the U.S. economy remains, as ongoing trade wars could push the country into a systemic crisis. In such a scenario, stock markets would continue to decline, and the cryptocurrency market would follow suit. The U.S. dollar could also face significant pressure from uncertainty and, at best, consolidate sideways near the 104.00 level on the ICE index. Meanwhile, as a safe-haven asset, gold might finally break through the key psychological level of $3,000 per ounce.

What can we expect in the markets today?

I believe we should anticipate a continuation of the previous trend, characterized by a lack of strong movements ahead of the Fed's monetary policy decision.

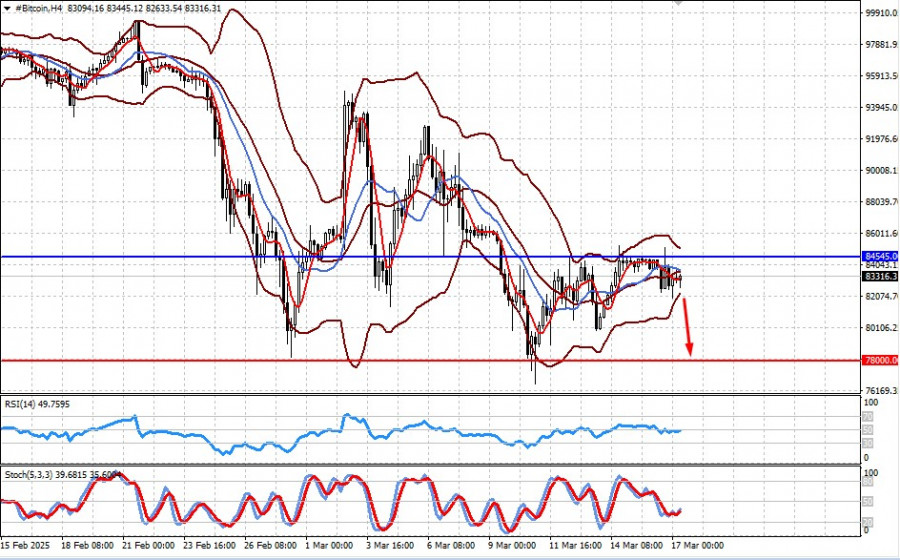

#Bitcoin

The token remains under pressure due to uncertainty stemming from U.S. presidential policies. Its inability to rise above the strong resistance level of 84,545.00 could lead to a renewed decline toward 78,000.00.

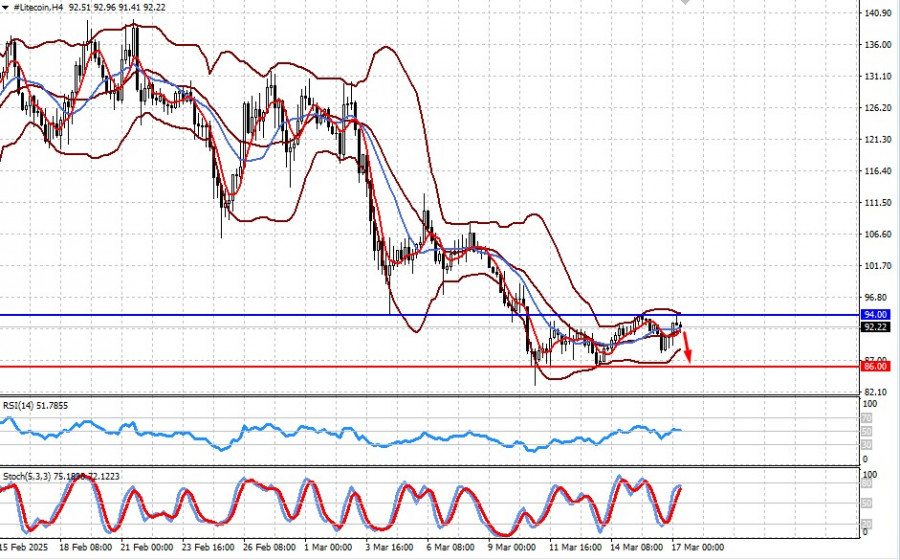

#Litecoin

The token is under intense pressure due to uncertainty linked to the U.S. president and his administration's policies. If it fails to break above the strong resistance level of 94.00, a further drop to 86.00 could follow.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pound British menyambung semula penurunannya selepas berita bahawa pinjaman kerajaan UK pada bulan Ogos melebihi ramalan, memberi tamparan kepada Canselor Perbendaharaan Rachel Reeves menjelang bajet musim luruh yang mencabar. Malahan

Harga emas jatuh daripada paras tertinggi baharu sepanjang zaman berikutan pengukuhan dolar AS, selepas Rizab Persekutuan mengumumkan pemotongan kadar faedah yang telah dijangkakan, susulan berbulan-bulan tekanan hebat daripada Rumah Putih

Analisis Laporan Makroekonomi: Sangat sedikit laporan makroekonomi yang dijadualkan pada hari Jumaat. Satu-satunya laporan yang perlu diberi perhatian adalah Jualan Runcit UK. Laporan ini boleh mencetuskan reaksi pasaran yang kecil—tetapi

Pasangan mata wang GBP/USD juga dengan mudah dan tenang kembali ke kedudukan asalnya pada hari Khamis, sebelum meneruskan penurunannya. Seperti yang kami nyatakan dalam artikel sebelum ini, adalah bijak untuk

Pasangan mata wang EUR/USD dengan tenang dan mudah kembali ke tahap asalnya pada hari Khamis, di mana ia berada sebelum keputusan mesyuarat Fed diumumkan. Ini adalah apa yang telah kami

Kami telah membincangkan keputusan mesyuarat Fed bulan September dalam ulasan sebelum ini—saya mencadangkan untuk membacanya. Sekarang tiba masanya untuk melihat persidangan akhbar Jerome Powell. Pengerusi Fed telah membuat beberapa pemerhatian

Justeru, Rizab Persekutuan telah membuat keputusan yang sepenuhnya dijangkakan dan langsung tidak mengejutkan. Kadar faedah telah diturunkan sebanyak 25 mata asas, namun inilah tepatnya yang telah dijangkakan oleh pasaran. Lebih

Mesyuarat FOMC dapat menghiburkan sesiapa sahaja yang mengikuti berita Amerika walaupun sedikit. Pada akhir bulan Ogos, salah seorang gabenor Fed, Adriana Kugler, meninggalkan jawatannya dalam keadaan yang agak pelik, hanya

Pasangan AUD/USD berada dalam zon turun naik yang ketara sejak beberapa hari kebelakangan ini. Pada hari Rabu, pembeli berjaya mempertahankan kedudukan pada paras 0.6709, manakala pada hari Khamis, penjual menolak

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.