Lihat juga

25.10.2021 01:00 PM

25.10.2021 01:00 PMEUR/USD

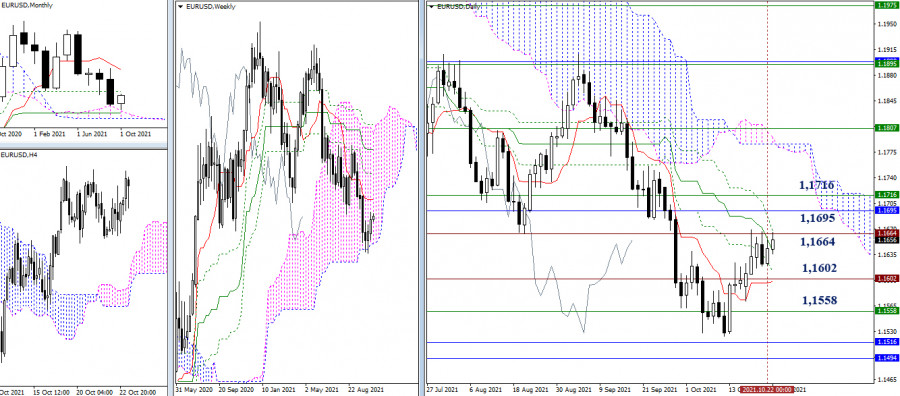

The slowdown below the historical resistance of 1.1664 remains. The final level of the Ichimoku daily dead cross (1.1667) has fallen into this area today. As a result, the breakdown of resistance will eliminate the bearish cross and help the bulls to strengthen their positions. The next upward targets are still at 1.1695 (monthly Fibo Kijun) and 1.1716 (weekly Tenkan). But in the case of bearish activity, the nearest support level of 1.1602 (historical level + daily levels) will be considered. The next interests can be directed to interacting with the level of 1.1558 (lower border of the weekly cloud) and 1.1516 - 1.1494 (monthly levels).

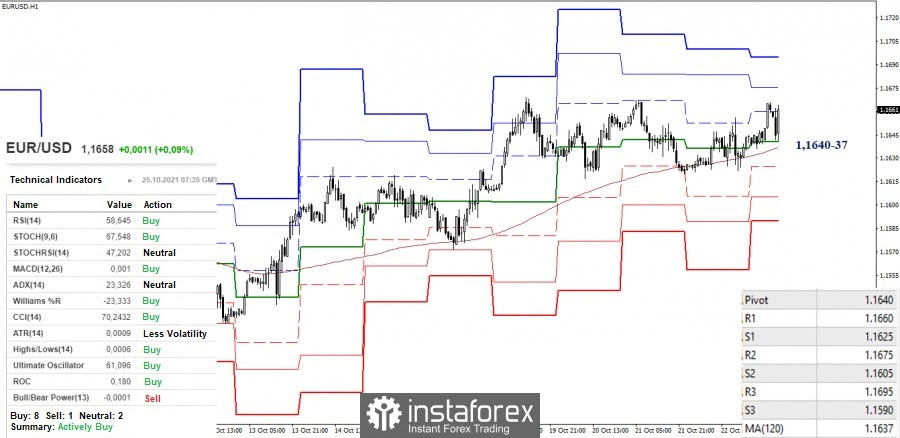

The pair continues to remain in the zone of the downward correction in the smaller timeframes. For a long time, the key support levels are being tested. They are joining forces in the area of 1.1640-37 today. A breakdown, consolidation below, and a reversal of moving averages will change the current balance of power in favor of the bears. The support for the classic pivot levels 1.1625 - 1.1605 - 1.1590 will serve as the intraday downward pivot points.

As for the bulls, the main task is to restore the upward trend (1.1669). The next upward pivot points can be 1.1675 (R2) and 1.1695 (R3), these resistances are being strengthened from the higher timeframes.

GBP/USD

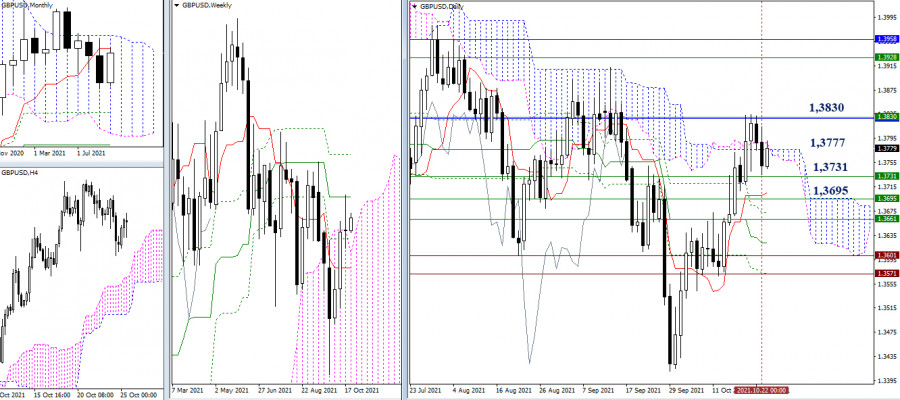

The bulls could not hold their positions below the encountered resistance level of 1.3830 (monthly short-term trend + weekly medium-term trend) during last week's closing. Currently, the attraction zone continues to provide a daily cloud (1.3777). The nearest support levels are set sequentially with some distance from each other – 1.3731 - 1.3695 - 1.3661 (daily and weekly levels).

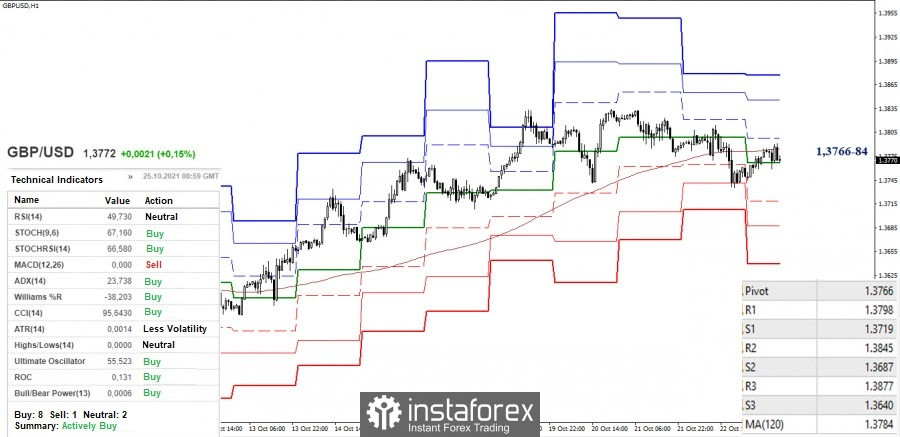

There is a struggle to reach the key levels in the smaller timeframes, which are uniting in the area of 1.3766-84 (central pivot level + weekly long-term trend). The continuation of the decline after the update of the low (1.3735) will open the way to the supports of the classic pivot levels (1.3719 - 1.3687 - 1.3640). On the contrary, a consolidation above the range of 1.3766-84 will set the task to recover the upward trend (1.3834). The resistances of the classic pivot levels 1.3845 and 1.3877 can be the additional upward pivot points within the day.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Semalam, seperti yang dijangkakan, ECB menurunkan kadar faedah utama sebanyak suku mata, menjadikan kadar pembiayaan semula kepada 2.15%. Dalam sidang akhbar, Presiden ECB Christine Lagarde menyatakan bahawa kadar telah kembali

Di sebalik sedikit optimisme semalam berikutan keputusan ECB untuk menurunkan kadar faedah dan hampir melengkapkan kitaran pelonggaran, pound hampir mencecah paras sasaran 1.3635. Hari ini bermula secara neutral, nampaknya dalam

Sehingga pagi ini, pasangan USD/JPY berada dalam situasi yang benar-benar maksud berganda — dengan kebarangkalian yang seimbang antara pertumbuhan dan penurunan. Petunjuk yang mencadangkan potensi pertumbuhan termasuk harga yang kekal

Pada awal sesi Eropah, euro didagangkan sekitar paras 1.1440, mengalami pembetulan teknikal selepas mencapai paras psikologi 1.15. Data Senarai Gaji Bukan Ladang AS akan diterbitkan dalam sesi dagangan Amerika

Di sisi lain, emas dijangka akan mengalami pembetulan teknikal. Pada 30 Mei, ia meninggalkan jurang sekitar 3,284, dan jika ia mengukuh di bawah 3,350, ia berkemungkinan besar boleh mencapai sasaran

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.