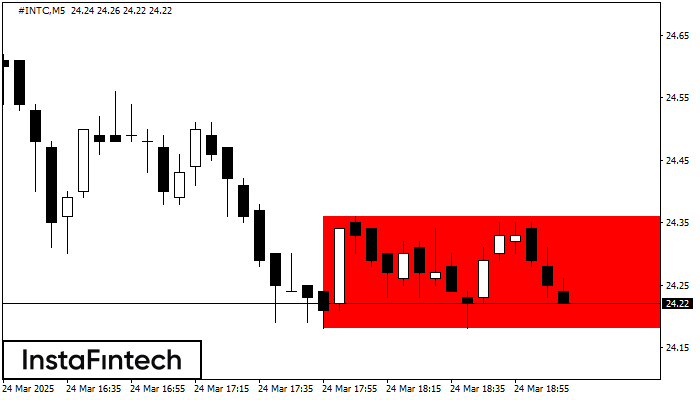

Bearish Rectangle

was formed on 24.03 at 19:11:46 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #INTC formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 24.36, the lower border is 24.18. The signal means that a short position should be opened after fixing a price below the lower border 24.18 of the Bearish Rectangle.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

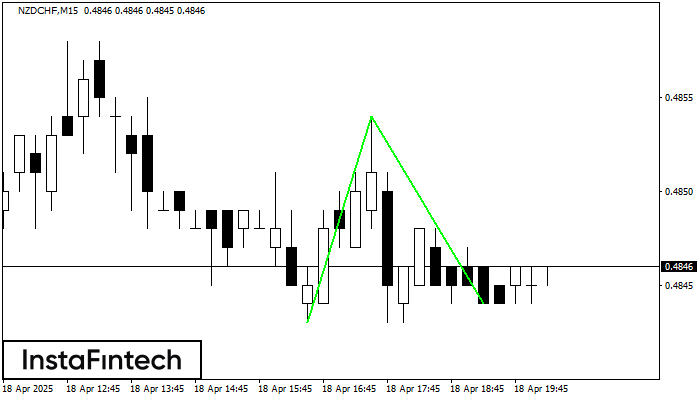

Double Bottom

was formed on 18.04 at 19:15:27 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDCHF M15; the upper boundary is 0.4854; the lower boundary is 0.4844. The width of the pattern is 11 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

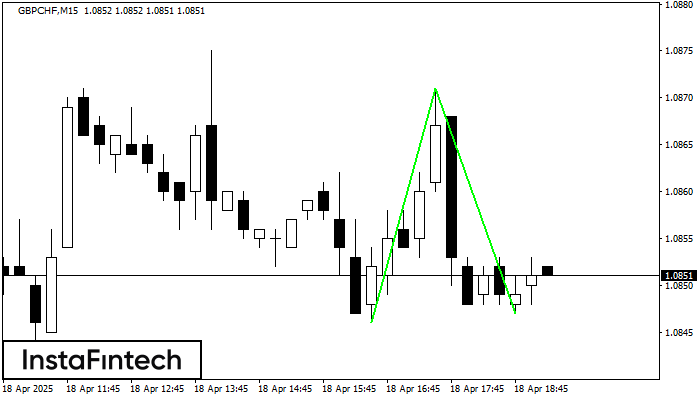

Double Bottom

was formed on 18.04 at 18:15:46 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on GBPCHF M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Head and Shoulders

was formed on 18.04 at 18:05:18 (UTC+0)

signal strength 1 of 5

The EURJPY M5 formed the Head and Shoulders pattern with the following features: The Head’s top is at 162.14, the Neckline and the upward angle are at 161.98/161.96. The formation

The M5 and M15 time frames may have more false entry points.

Open chart in a new window