AUDNOK (Australian Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

13 Jun 2025 23:59

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/NOK is not a very popular currency pair in the Forex market. It is the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant impact on it. This can be seen if you combine two charts ― AUD/USD and USD/NOK. By combining these two charts in the same price chart, you can get an approximate AUD/NOK chart.

The U.S. dollar has a significant influence on both currencies. For this reason, it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include the discount rate, GDP, unemployment, new vacancies and many others. It is worth noting that the discussed currencies could respond to U.S. economic changes with different speed. Therefore, the AUD/NOK pair may be a specific indicator of changes in these currencies.

Norway is one of the leading industrial-agrarian countries. The country is number one in terms of quality of life and personal income level. This Scandinavian country is the third largest producer and exporter of oil and gas. The main source of Norway’s income is the export of energy resources. In addition, Norway is a leader in electrometallurgy, electrical engineering, mechanical engineering, mining as well as processing of seafood, which is in high demand worldwide, especially in European countries. In addition, it is the largest manufacturer of offshore drilling platforms for oil and gas.

This trading instrument is relatively illiquid in comparison with major currency pairs, such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a forecast for the financial instrument, you should primarily focus on those currency pairs that include the U.S. dollar in tandem with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than more popular currency pairs, so before you start working with the cross rates, carefully learn the conditions offered by the broker to trade a preferred instrument.

See Also

- Technical analysis

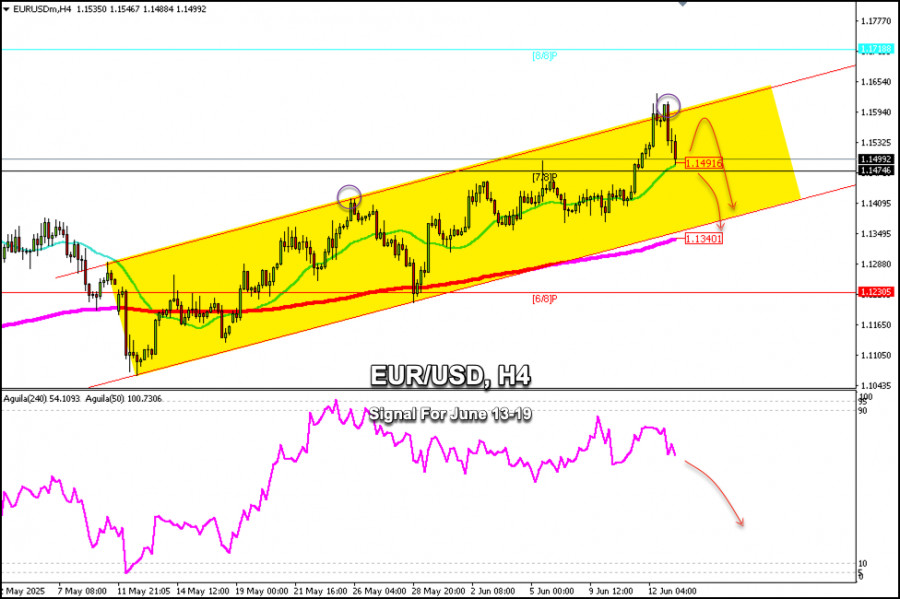

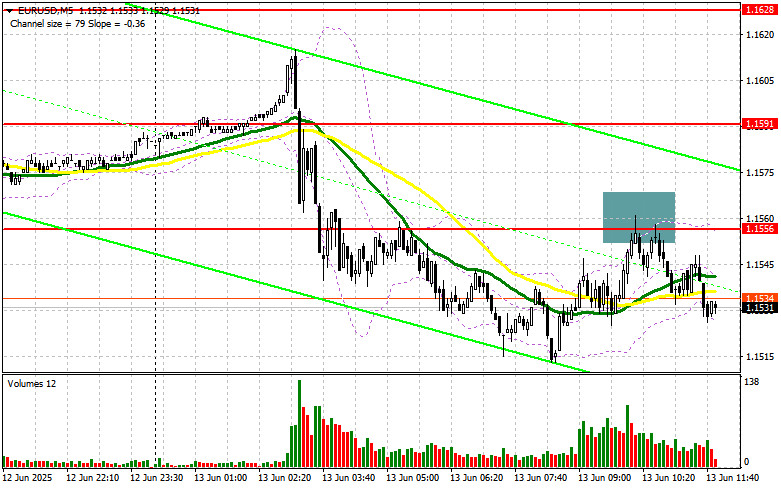

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

2773

GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:44 2025-06-13 UTC+2

2323

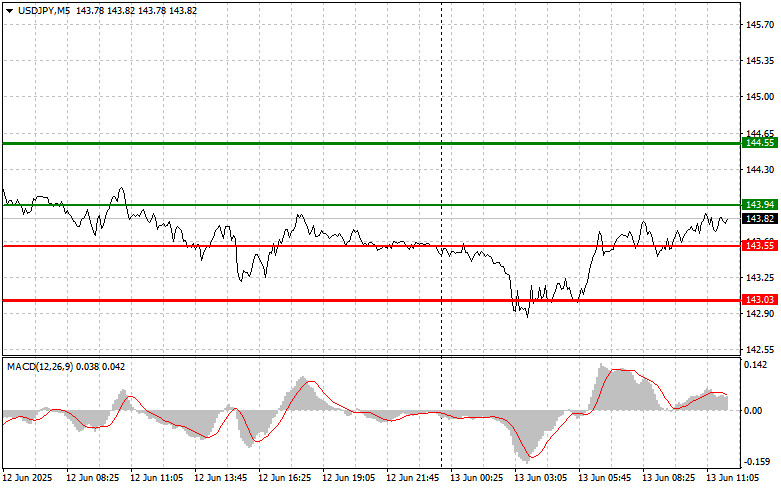

USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:49 2025-06-13 UTC+2

2203

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2158

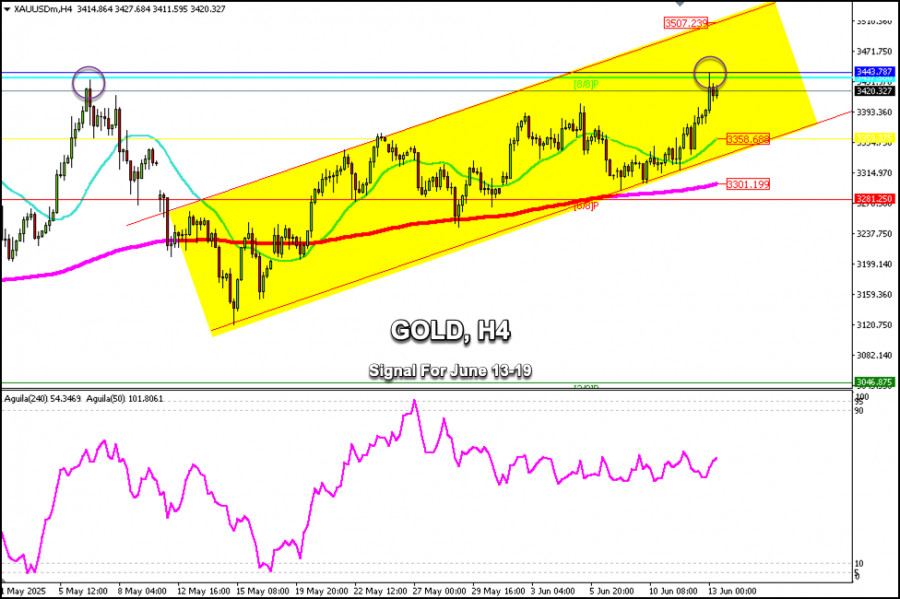

Technical analysisTrading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2083

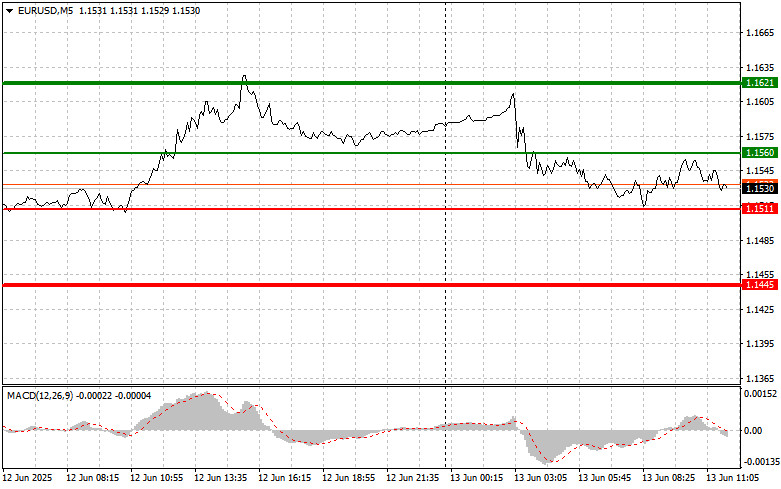

EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:41 2025-06-13 UTC+2

1888

- EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)

Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1768

The crowd will be punished for its overconfidence in buying the S&P 500 dipAuthor: Marek Petkovich

09:35 2025-06-13 UTC+2

1768

Pressure persists despite short-term reboundAuthor: Irina Yanina

12:53 2025-06-13 UTC+2

1678

- Technical analysis

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

2773

- GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:44 2025-06-13 UTC+2

2323

- USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2203

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2158

- Technical analysis

Trading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2083

- EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

1888

- EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)

Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1768

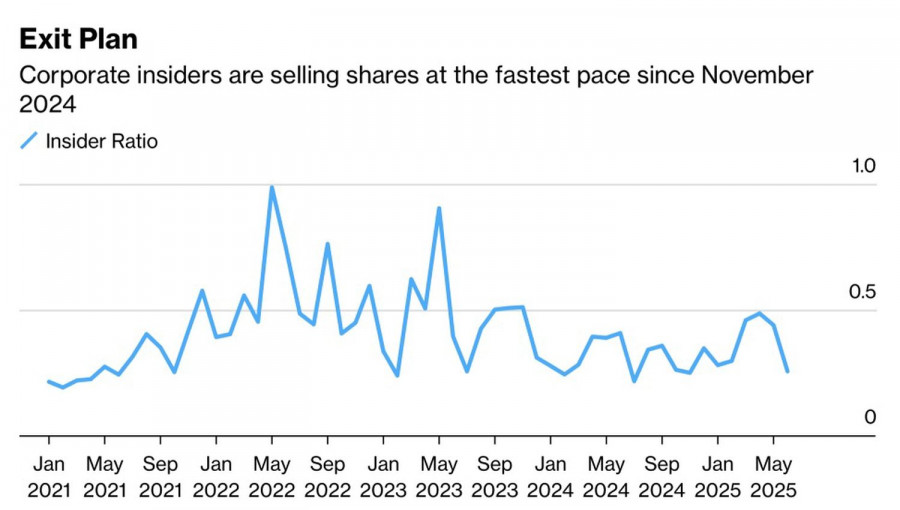

- The crowd will be punished for its overconfidence in buying the S&P 500 dip

Author: Marek Petkovich

09:35 2025-06-13 UTC+2

1768

- Pressure persists despite short-term rebound

Author: Irina Yanina

12:53 2025-06-13 UTC+2

1678