AUDCZK (Australian Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

13 Jun 2025 23:59

(-0.05%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/CZK pair is not in high demand among forex traders. This is a cross-rate pair. Thus, a trader buys USD for CZK at the current USD/CZK exchange rate, and buys AUD for dollars at the current AUD/USD exchange rate.

The US dollar has a significant impact on both currencies. So, when trading this instrument, speculators should take into account important US macroeconomic indicators such as GDP, the interest rate, unemployment rate, and labor market figures, etc. Notably, the Australian dollar and Czech koruna react to the release of US economic data at a different speed. This is why the AUD/CZK pair can serve as an indicator of the swings in the rate of both currencies.

Main features. How to trade AUD/CZK

The Czech Republic is one of the most industrially developed countries in Europe as well as one of the most prosperous and stable countries in the euro area. Besides, the country can boast of robust economic growth. This is why its population has a high per capita income.

The Czech Republic is on the list of the world's top car manufacturers. Most of the produced cars are exported. In addition, the country is the main exporter of beer and shoes. The Czech Republic is one of the leaders when it comes to the production of electronics. The country generates electricity in various ways: at nuclear power plants, thermal power plants, hydroelectric power plants as well as with the help of solar and wind power plants.

The AUD/CHF pair has rather low liquidity compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this instrument, it is necessary to focus on the pairs traded against the US dollar.

If you want to start trading cross-rates, please carefully read the trading conditions of your broker. Usually, spreads for these instruments are higher than for the main currency pairs.

See Also

- Technical analysis

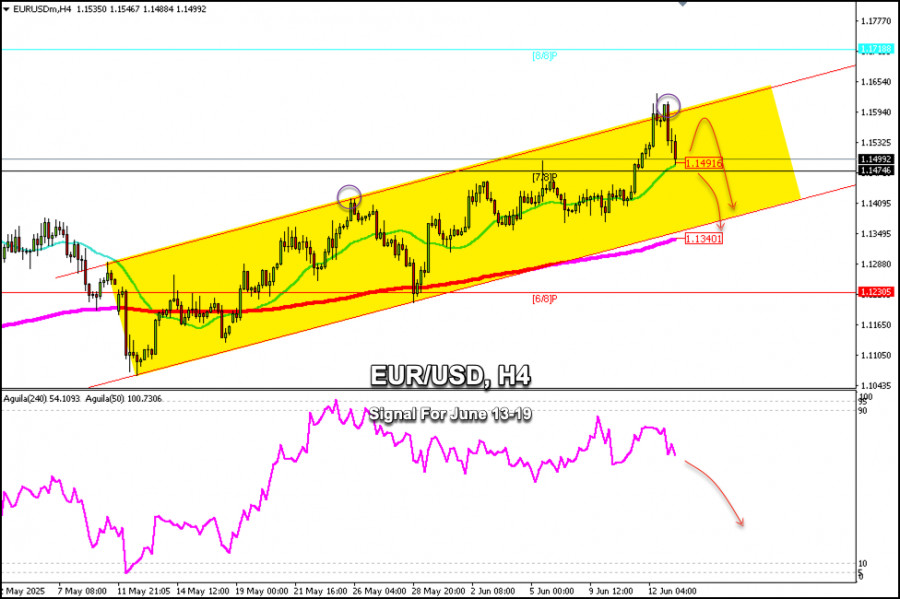

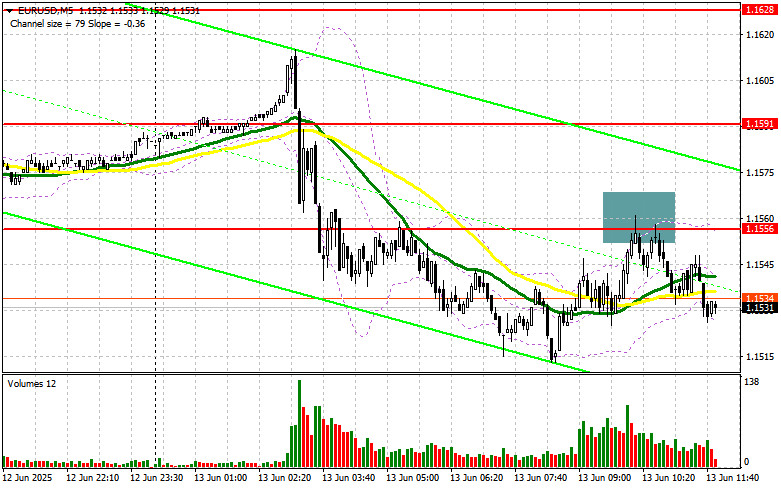

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

3913

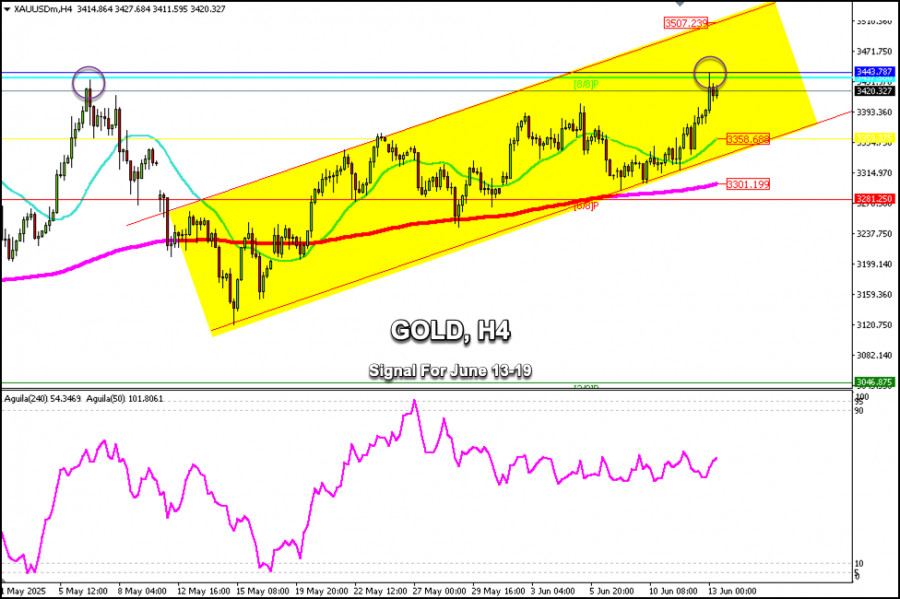

Technical analysisTrading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2938

GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:44 2025-06-13 UTC+2

2593

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2473

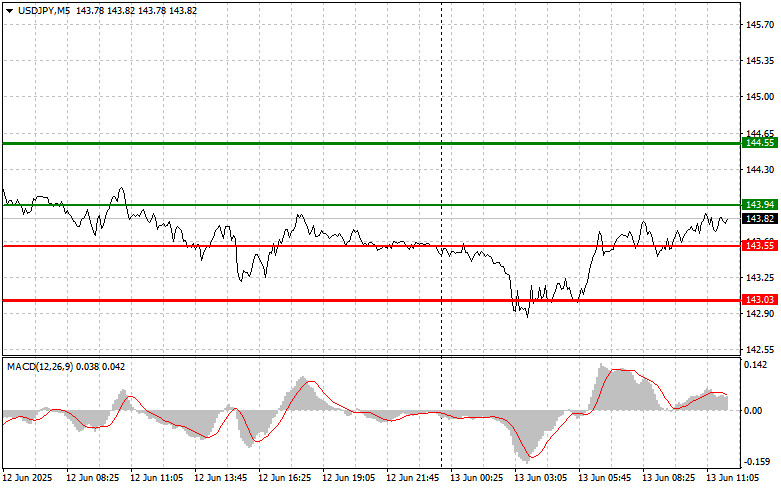

USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:49 2025-06-13 UTC+2

2443

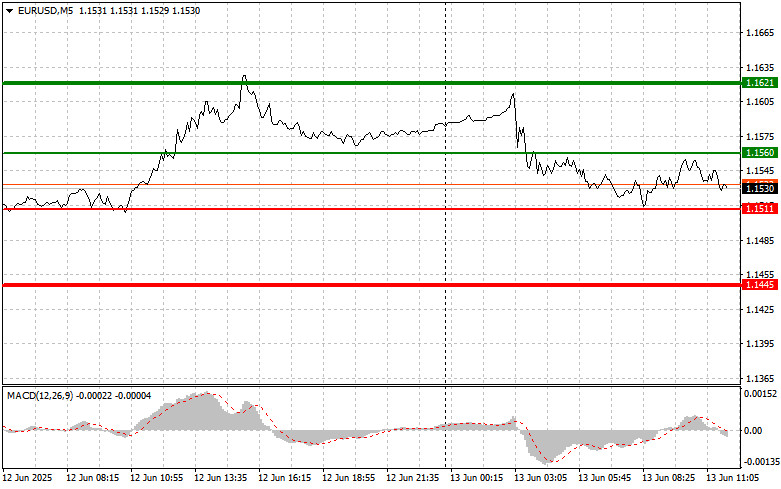

EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:41 2025-06-13 UTC+2

2128

- Fundamental analysis

Israeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2083

The crowd will be punished for its overconfidence in buying the S&P 500 dipAuthor: Marek Petkovich

09:35 2025-06-13 UTC+2

2008

EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1978

- Technical analysis

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

3913

- Technical analysis

Trading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2938

- GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:44 2025-06-13 UTC+2

2593

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2473

- USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2443

- EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

2128

- Fundamental analysis

Israeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2083

- The crowd will be punished for its overconfidence in buying the S&P 500 dip

Author: Marek Petkovich

09:35 2025-06-13 UTC+2

2008

- EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)

Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1978