Lihat juga

03.04.2025 11:25 AM

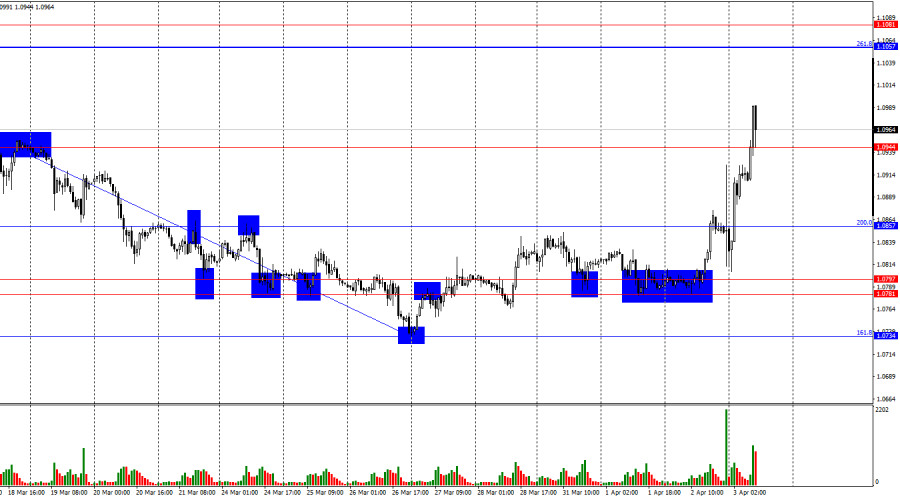

03.04.2025 11:25 AMOn Wednesday, the EUR/USD pair surged sharply. This movement can hardly be called a mere rise. When it comes to the U.S. dollar, it was another collapse—one of many seen in 2025, more frequent than before Donald Trump came to power. As of yesterday and this morning, the pair firmly broke above the 1.0944 level, opening the way for the euro to reach the 261.8% Fibonacci retracement level at 1.1057. For now, considering a decline in EUR/USD seems unreasonable.

The wave pattern on the hourly chart has shifted. The last completed downward wave broke below the previous low, but the most recent upward wave has exceeded the previous high. This currently indicates a reversal in trend to a bullish direction.

Donald Trump imposed new tariffs last week and followed up this week with global tariffs on all categories of goods. Bulls had shown weakness recently, but as it turned out yesterday, it wasn't weakness—it was simply anticipation.

The fundamental backdrop on Wednesday is hardly worth analyzing. The U.S. ADP labor market report was released but largely ignored by traders. The dollar began falling as soon as the U.S. session opened. Clearly, the market was bracing for the worst even before Trump's speech at the White House. As it turned out, they were right.

President Trump imposed new tariffs—not selectively this time, but on all American imports. And that's not all. Several countries were hit with individual tariff rates, some as high as 70–90%. All previous trade actions by Trump now seem mild by comparison. Now, every country in the world will, in one way or another, pay to access the U.S. market—or abandon it altogether—or be forced to slash exports. As before, the dollar plunged on such news, regardless of any technical indicators.

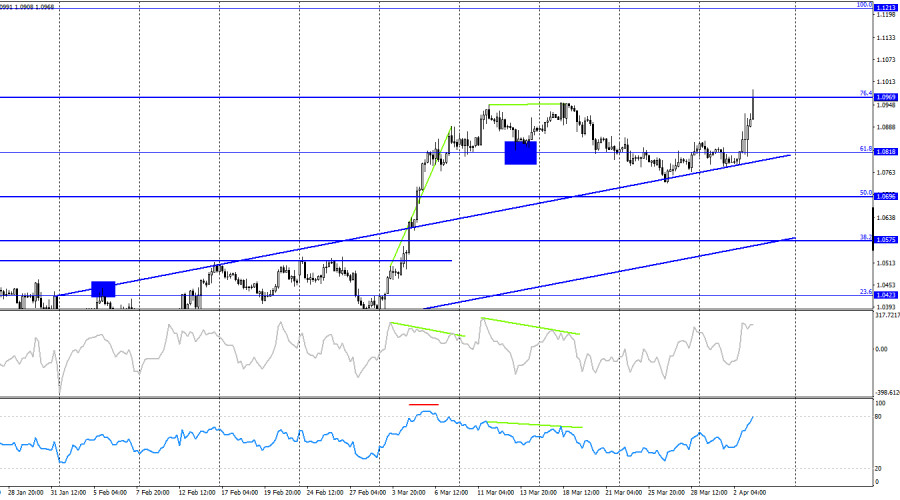

On the 4-hour chart, the pair has made a new bullish reversal and is rising toward the 76.4% Fibonacci level at 1.0969. The euro's growth, unsupported by EU data, should have ended long ago—but Trump's actions continue to weigh heavily on the dollar. A rebound from the 1.0969 level may prompt a slight pullback, but who's thinking about a decline now? A close above 1.0969 will likely lead to continued growth toward the next Fibonacci level at 1.1213.

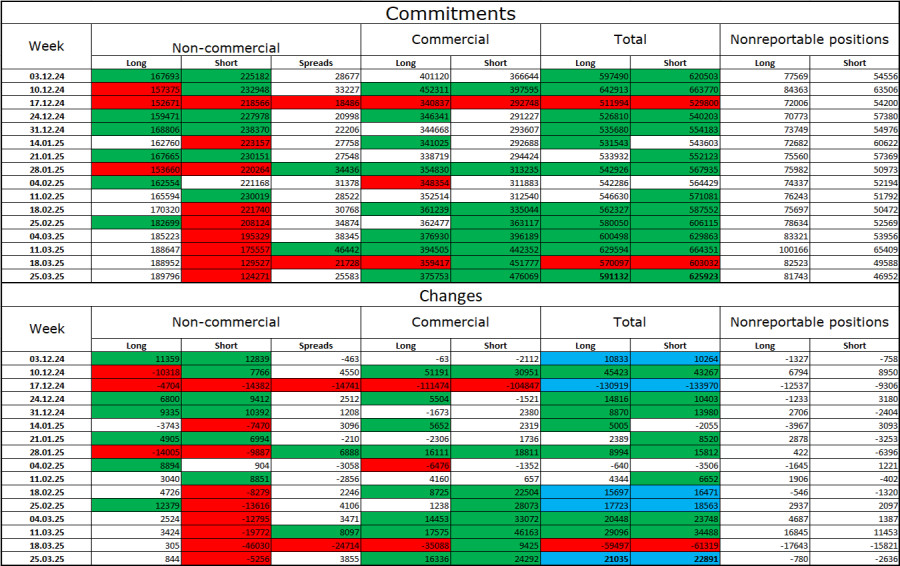

Commitments of Traders (COT) Report

During the latest reporting week, professional traders opened 844 new long positions and closed 5,256 short ones. The "non-commercial" group sentiment became bullish again—thanks to Donald Trump. The total number of long positions held by speculators now stands at 190,000, while short positions are down to 124,000.

For 20 consecutive weeks, large traders had been selling off the euro. But for the past 7 weeks, they've been closing shorts and adding longs. The ECB–Fed policy divergence still favors the dollar, but Trump's policies are now a more significant factor for traders, as they could push the FOMC into a dovish stance and potentially trigger a U.S. recession.

Economic Calendar – April 3 (U.S. and EU):

While the April 3 calendar includes three very important events, it's unclear whether the market will even care about them. Market sentiment on Friday will likely be driven more by Trump's actions than by strong U.S. data.

EUR/USD Forecast and Trader Tips:

In the current environment, I would not consider selling the pair. Buying was possible yesterday on a rebound from the 1.0781–1.0797 zone (H1 chart) with a target of 1.0857. The next target at 1.0944 was also reached and broken, so long positions can be held with a new target at 1.1057.

Fibonacci levels were drawn between 1.0529 and 1.0213 on the hourly chart, and between 1.1214 and 1.0179 on the 4-hour chart.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Indikator Eagle menunjukkan sinyal negatif, yang mengisyaratkan bahwa penurunan harga emas dapat berlanjut dalam beberapa hari mendatang. Untuk itu, kita harus memperhatikan zona 3,281; di bawah area ini, prospeknya bisa

Bitcoin mencapai level tertinggi di atas $111,850 di dekat area +2/8 Murray, yang mewakili zona jenuh beli yang ekstrem. Bitcoin bisa mengalami penurunan tajam dalam beberapa hari mendatang dan mencapai

EUR/USD diperdagangkan di sekitar 1,1287 setelah mencoba untuk menembus puncak channel tren menurun. Instrumen ini sekarang berkonsolidasi di sekitar SMA 21, yang menunjukkan bahwa EUR/USD kemungkinan akan melanjutkan penurunannya dalam

Dengan munculnya Divergence antara pergerakan harga indeks Nasdaq 100 yang membentuk Double Top dengan indikator Stochastic Oscillator ditambah konfirmasi dengan pergerakan harganya yang bergerak dibawah WMA (21) memiliki kemiringan yang

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.