Lihat juga

02.04.2025 08:50 AM

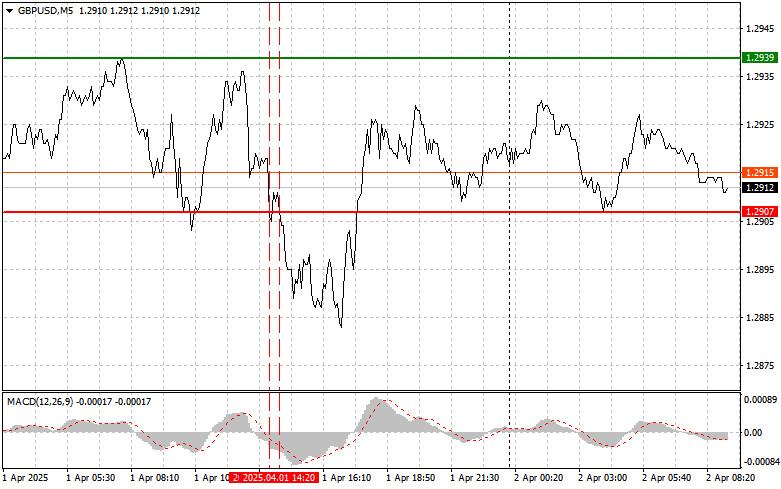

02.04.2025 08:50 AMThe price test at 1.2907 occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downside potential. For that reason, I did not sell the pound. A second test of 1.2907, with the MACD in the oversold zone, triggered Scenario #2 for buying the pound, but the pair failed to rise afterward, resulting in a loss being locked in.

Weak U.S. Manufacturing PMI data limited the downside potential for the British pound only by the mid-U.S. session. It's clear that today, traders will act cautiously, awaiting further economic signals that could shed light on the interest rate outlooks for both the Federal Reserve and the Bank of England. Despite some volatility, the pound continues to demonstrate resilience. Today, in the absence of UK news, market participants will closely monitor the political landscape, which now entirely hinges on the U.S. tariff decisions.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

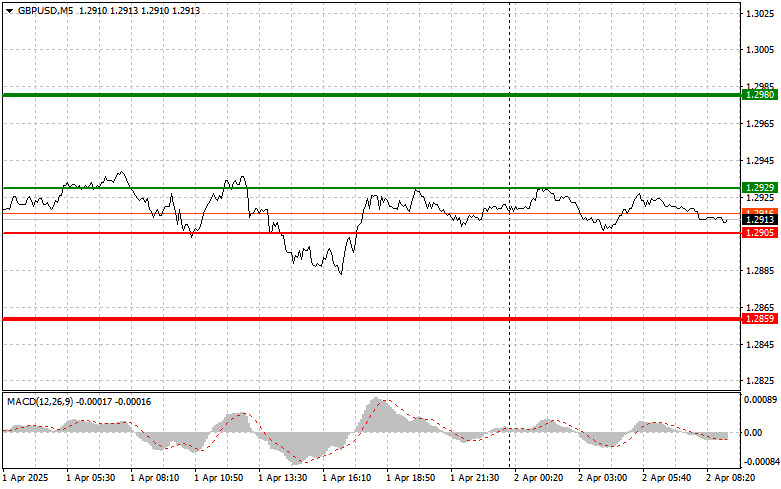

Scenario #1: I plan to buy the pound today at the entry point near 1.2929 (green line on the chart), targeting a rise to 1.2980 (thicker green line). Around 1.2980, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip pullback). Buying the pound makes sense only as part of a minor correction within the channel. Important: Before buying, ensure the MACD is above the zero line and beginning to rise.

Scenario #2: I will also consider buying the pound after two consecutive tests of 1.2905 when the MACD is in oversold territory. This would limit the pair's downside and trigger a bullish reversal. A rise toward 1.2929 and 1.2980 could then be expected.

Scenario #1: I plan to sell the pound after it breaks below 1.2905 (red line on the chart), which could lead to a swift decline in the pair. The main target for sellers will be 1.2859, where I plan to exit short positions and open immediate long positions (expecting a 20–25 pip rebound). Important: Before selling, ensure the MACD is below the zero line and starting to fall from it.

Scenario #2: I will also consider selling the pound after two consecutive tests of 1.2929 when the MACD is in the overbought zone. This would limit the upside potential and trigger a bearish reversal. A decline toward 1.2905 and 1.2859 may follow.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Brent sedang berjuang untuk tetap bertahan, bahkan ketika ancaman serangan terhadap Iran dan perkembangan baru dalam diplomasi sanksi AS mulai terlihat. Sementara itu, gas alam saat ini menghadapi kesulitan karena

Pengujian level 144,86 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar dan menghasilkan kenaikan lebih dari

Uji level 1,3342 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua level ini terjadi

Uji harga pada 1.1312 di paruh kedua hari itu bertepatan dengan indikator MACD yang sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua pada

Euro dan pound kembali mengalami penurunan segera setelah kepercayaan pasar terhadap tercapainya kesepakatan dagang AS dengan mitra utama meningkat. Setelah menandatangani perjanjian dagang dengan Inggris, komentar lembut Donald Trump mengenai

Analisis dan Tips Trading untuk Pound Inggris Uji harga di 1.3330 pada paruh pertama hari ini bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik

Analisis dan Tips Trading untuk Euro Uji harga di 1.1321 terjadi tepat saat indikator MACD mulai bergerak turun dari titik nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya

Uji harga di 143,18 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Situasi serupa terjadi dengan

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.