Lihat juga

31.03.2025 10:58 AM

31.03.2025 10:58 AMRecent news from the cryptocurrency market has discouraged investors. Over the past weekend, Bitcoin and Ether experienced sharp drops and failed to return to their upward trajectory, indicating a high probability of further market correction, especially in the absence of positive news.

As recent data shows, daily cryptocurrency trading volumes have significantly decreased compared to the peak levels reached after the presidential elections and now stand at around $35 billion, which is roughly the level recorded before Donald Trump's victory in the presidential elections.

After the elections on November 5, daily trading volumes surged to $126 billion, fueled by increased market enthusiasm and speculative activity. This represents a decline of about 70% from the peak, returning the market to pre-election base levels in a rather short period, which is a rather poor signal for the medium-term bullish market. Recent announcements of new tariffs against major US trading partners have introduced uncertainty, which has dampened trading enthusiasm in both traditional and cryptocurrency markets. The total market capitalization of cryptocurrencies reached approximately $3.9 trillion at its peak, before pulling back to the current level of around $2.9 trillion.

However, a reduction in trading volume may signal several potential market events in the coming months. Historically, long periods of decreasing volumes have often preceded significant market movements, as liquidity reduction can amplify price impacts when larger players start shifting positions. Once there is more clarity on the Trump administration's full approach to cryptocurrency regulation, demand for risk assets may resume. However, for this to happen, a recovery in the stock market is also necessary, as the cryptocurrency market has recently been strongly correlated with it.

Demand for BTC has been waning and has already dropped to lows not seen since December 2023, according to CryptoQuant data. This trend is also driven by factors including ongoing macroeconomic uncertainty and overall risk aversion among investors. The decrease in demand is reflected in reduced trading volumes on major crypto exchanges, as I mentioned earlier, and in a decline in the number of active wallets interacting with BTC. Besides, there has been an outflow of BTC from exchanges, which may indicate that long-term investors prefer to hold onto their assets rather than actively sell them.

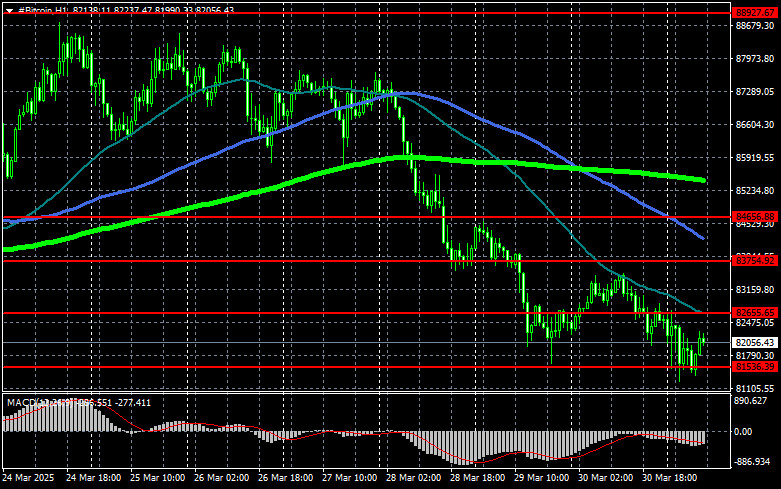

Technical picture of Bitcoin

Buyers are currently aiming for a return to the $82,600 level, which would open a direct path to $83,700. From there, it would be just a step away from $84,600. The furthest target will be the high near $85,900. Once this level is overcome, it would signal a return to a bullish market. In case of a decline, I expect buyers to appear at the $81,500 level. A return of the trading instrument below this area could quickly push the price down to $80,500. The furthest target in this case would be $79,400.

Technical picture of Ethereum

A clear consolidation above $1,831 opens a direct path to $1,864. The furthest target will be the high near $1,898. Overcoming this would signal a return to a bullish market. In case the price declines, I expect buyers to appear at the $1,784 level. A return of the trading instrument below this area could quickly push the price down to $1,750. The furthest target in this case would be the $1,717 area.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Upaya yang tidak berhasil kemarin untuk tetap di atas $94.000 menunjukkan bahwa masih ada minat beli yang signifikan. Ethereum juga bertahan dengan cukup baik, meskipun koreksi kemarin selama sesi Eropa

Dengan kondisi indikator Stochastic Oscillator yang sudah berada diatas level Overbought (80) meski saat ini masih bergerak diatas WMA (30 Shift 2) dimana ini menandakan biasnya masih Bull, namun berdasarkan

Meski saat ini mata uang kripto Solana tengah bergerak dalam kondisi yang menguat dimana hal ini ditandai oleh pergerakan harganya yang bergerak diatas WMA (30 Shift 2) namun dengan kemunculan

Pola gelombang pada grafik 4 jam untuk BTC/USD menjadi agak lebih kompleks. Kami mengamati struktur korektif ke bawah yang menyelesaikan formasinya di sekitar angka $75,000. Setelah itu, pergerakan naik yang

Kemarin bitcoin mengalami rally yang kuat. Setelah menembus level $90.000, cryptocurrency terkemuka ini melonjak menuju $94.000, tempat kenaikan tersebut sementara terhenti. Ether juga mencatatkan kenaikan yang mengesankan. Setelah diperdagangkan

Bitcoin berhasil menembus di atas $90.000, sementara Ethereum naik lebih dari 10% hanya dalam satu hari, kembali ke $1.800. Yang menjadi katalis utama adalah pernyataan Donald Trump kemarin, yang menjelaskan

Bitcoin Kembali ke Zona $88.000, tetapi Ethereum Menghadapi Tantangan Penjualan kemarin selama sesi AS, kembali dipicu oleh penurunan indeks saham Amerika, yang diimbangi oleh pembeli Bitcoin, sementara Ethereum hanya sedikit

Bitcoin dan Ethereum, setelah menghabiskan seluruh akhir pekan bergerak menyamping dalam rentang tertentu, melonjak tajam selama sesi Asia hari ini. Kenaikan ini dipicu oleh rumor bahwa Ketua Federal Reserve

Setelah berhasil keluar dari pola Ascending Broadening Wedge di chart 4 jamnya mata uang kripto Litecoin yang diikuti oleh munculnya Divergence antara pergerakan harga Litecoin dengan indikator Stochastic Oscillator serta

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.