Lihat juga

02.06.2022 12:24 PM

02.06.2022 12:24 PMHi, dear traders!

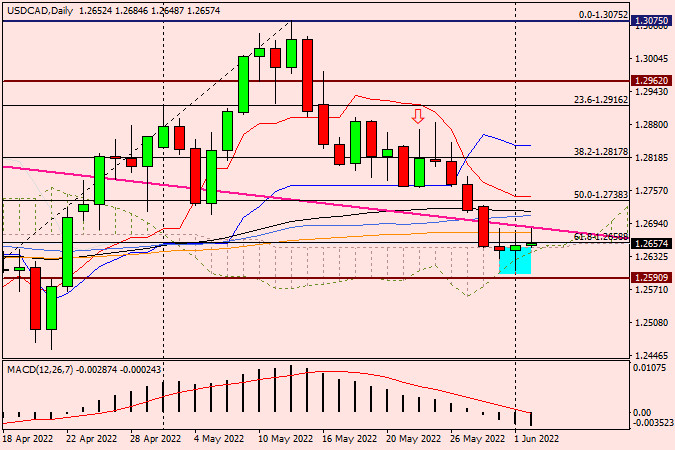

Yesterday, the Bank of Canada increased its key interest rate by 50 basis points to 1.50%, matching market expectations. However, some analysts expected a 75 basis point hike. In its release about the decision, the Bank of Canada stated it was not the last rate increase and that it was prepared to act more forcefully if needed. The regulator is determined to bring high inflation, which soared well above the target level during and after the pandemic, under control. "Canadian economic activity is strong, and the economy is clearly operating in excess demand," the central bank said. These economic conditions boost the Bank of Canada's resolve. The conflict in Ukraine pushed energy prices upwards, creating additional uncertainty and increasing inflationary risks. The Bank of Canada expects inflation to remain high and stated it would continue increasing interest rates. Despite the clearly hawkish tone of the Canadian central bank, the hike did not give support to the Canadian dollar, as market players have already priced in the rate move. USD/CAD reversed upwards from 1.2600 and recovered some of its losses, closing at 1.2652 and creating a candlestick with a long lower shadow on the daily chart. Similar to USD after the Federal Reserve's two rate hikes, CAD experienced bearish pressure.

Currently, USD/CAD is trading in a narrow range of 1.2606-1.2684. The pair's further trajectory remains unclear. Tomorrow's US labor market data could push USD/CAD out of the sideways trend, and the direction of this movement would likely determine the new trend. In this situation, there are good opportunities for both long and short positions. Short positions can be opened at 1.2675 and 1.2685. Long positions could be opened if the pair falls into the 1.2615-1.2600 zone. Traders should wait for appropriate candlestick signals before entering the market.

Good luck!

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Selasa, pasangan EUR/USD berbalik menguntungkan euro dan naik ke zona resistance 1,1374–1,1383. Pemantulan dari zona ini memicu penurunan yang menguntungkan dolar AS, dengan pasangan ini kembali turun menuju

Bila Kita perhatikan chart 4 jam dari pasangan mata uang silang AUD/JPY, maka akan nampak pola Descending Broadening Wedge dimana pola ini memberi petunjuk kalau dalam waktu dekat ini AUD/JPY

Pada chart 4 jamnya, instrumen komoditi Gas Alam nampak terlihat pola bearish 123 yang diikuti oleh bearish Ross Hook (RH) ditambah konfirmasi pergerakan harga berada dibawah WMA (21) yang juga

Sebenarnya, euro sedang mengalami kelelahan. Jadi, prospek penurunan bisa tetap berlaku selama EUR/USD berada di bawah 1,1370. Dalam jangka pendek, nilai ini mungkin mencapai EMA 200 yang terletak di 1,08

Pada awal sesi Amerika, emas diperdagangkan sekitar 3.381, mundur setelah mencapai titik tertinggi sekitar 3.397. Emas sebagai aset safe haven merasa gelisah karena ketegangan geopolitik di seluruh dunia. Dari sisi

Pada hari Senin, pasangan EUR/USD membuat pembalikan baru yang menguntungkan dolar AS, tetapi kali ini penurunannya bahkan lebih lemah. Selama sebagian besar minggu lalu, penjual melancarkan serangan yang lesu, karena

Pada grafik per jam, pasangan GBP/USD terus bergerak mendatar pada hari Senin. Pergerakan mendatar ini dimulai minggu lalu ketika serangkaian laporan penting dirilis di AS, dan perdagangan aktif diharapkan dari

Dengan pergerakan harga yang membentuk Higher Low - Lower Low serta didukung oleh kemiringan WMA (30 Shift 2) yang menurun serta pergerakan harga Minyak Mentah yang bergerak dibawahnya, maka jelas

Pada chart 4 jamnya, pasangan mata uang silang GBP/AUD nampak terlihat masih didominasi oleh para Sellers dimana hal ini terkonfirmasi oleh pergerakan harganya yang bergerak dibawah WMA (30 Shift 2)

Pada awal sesi Amerika, pasangan EUR/USD diperdagangkan di sekitar 1,1345, mencapai puncak channel tren menurun dan menunjukkan tanda-tanda kelelahan. Euro dapat melanjutkan siklus bearish-nya jika berkonsolidasi di bawah 1,1370 dalam

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.