#BHP (BHP Billiton Limited). Exchange rate and online charts.

Currency converter

21 Mar 2025 21:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

BHP is a ticker symbol for the shares of BHP Billiton, which are traded on the LSE (London), JSE (Johannesburg), ASX (Australia), as well as in the form of American depositary receipts (ADRs) on the NYSE (New York).

BHP Billiton conducts exploration, development, production, processing of oil, gas, iron ore, metallurgical coal, diamonds, non-ferrous, and precious metals.

Technically, BHP Billiton consists of 2 companies: BHP Billiton Limited (Australia) and BHP Billiton Plc. (the UK and the Netherlands). It has 2 headquarters: the head office is located in Melbourne and the second one in London. For the same reason, the shares of Australian and British divisions of BHP are traded on the exchanges independently of each other.

History

Since BHP Billiton was established in 2001 in The Hague as a result of a merger of 2 companies, its history can be divided into 2 parts.

BHP Billiton Limited located in Australia was founded in 1885. It started with the field exploration of lead, zinc, and silver deposits. In 1899 it produced iron ore in the Iron Knob deposit.

After the First World War, the company bought up deposits of coal, iron ore, as well as enterprises that produced finished steel products. In 1967, Billiton Limited (Bass Strait) began the oil business. Since the 1970s, it has been engaged in the development of foreign deposits: copper in Chile, coal in New Mexico, diamond in Canada in the 1990s, and natural gas in offshore zones of Australia.

BHP Billiton Plc. (the UK division) began to mine bauxite in 1851 in Indonesia on the island of Billiton. The company was registered 9 years later in 1860. In 1935-1939, BHP Billiton Plc. produced bauxite on the island of Suriname, Indonesia, and 20 years later in Guinea-Bissau. In 1978-1987, it built numerous factories in Europe. In 1997, the company was listed on the London Stock Exchange.

Merger

At the time of the merger with BHP Billiton Group in 2001, the companies agreed to keep their separate identities and listings on the Australian and London stock exchanges. BHP owns 58% of the new company and Billiton holds 42%. The merger was strategically beneficial for Billiton Ltd. with free margin but a slow pace of development, while Billiton Plc. was a dynamically growing company that lacked the funds to consolidate the assets.

The company uses special schemes for dealing with Austrian and European shares: the dividends are paid equally but the shareholders' meetings are held separately. At the same time, BHP Billiton is managed by two equal boards of directors and a CEO.

Revenue and achievements

In 2005, BHP Billiton was recognized as the most successful company of the year among 2,200 companies from 24 countries.

In 2004, the turnover totaled $24.8 billion with a net profit of $5.5 billion. In 2019, net profit amounted to $8.31 billion and was the highest in the last five years.

Nowadays, BHP Billiton is the world's largest diversified mining company in the field of extraction and use of natural resources. Its global technology divisions have research centers in Australia, South Africa, China, etc.

The corporation is engaged in more than 100 projects in 26 countries around the world. BHP Billiton is constantly expanding, buying up assets, and creating a joint venture with the largest mining companies on all continents. The number of employees amounts to 72,000. In 2018, its assets totaled $111.993 billion. The company's revenue is $44.29 billion (as of 2019).

See Also

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1723

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

1693

The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.Author: Chin Zhao

19:42 2025-03-21 UTC+2

1603

- Technical analysis

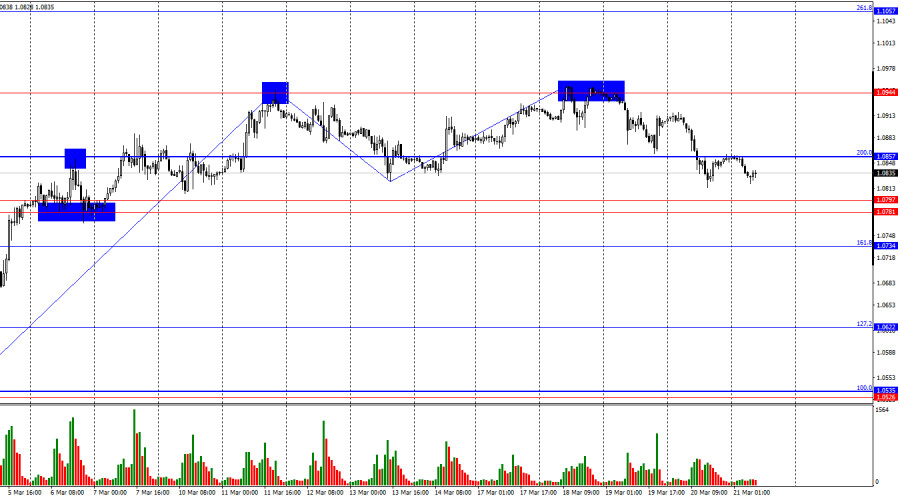

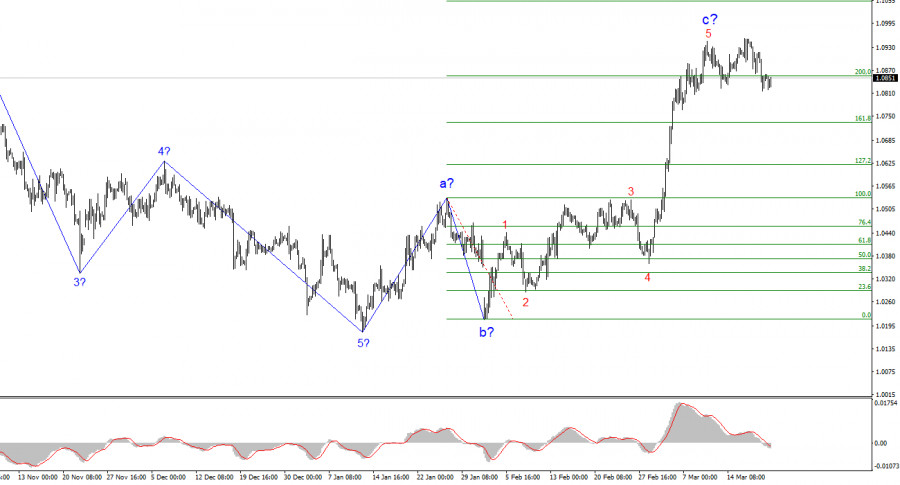

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1603

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

1573

The outcomes of the Bank of England and FOMC meetings contradicted each otherAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

1438

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1438

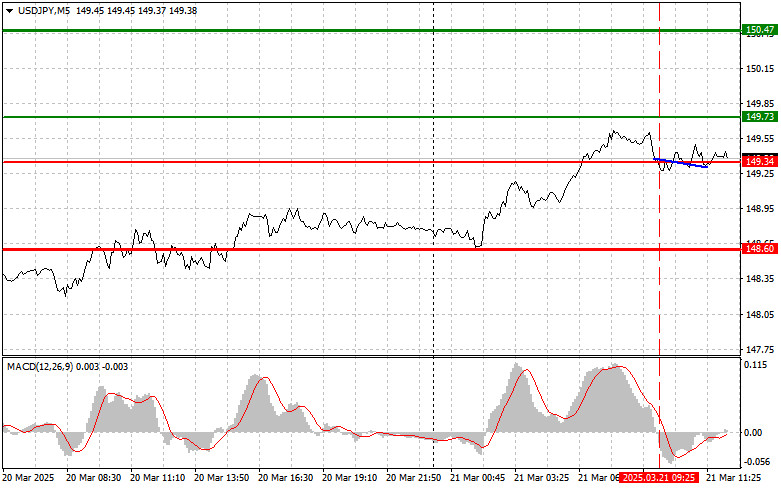

USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Author: Jakub Novak

19:30 2025-03-21 UTC+2

1423

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.Author: Chin Zhao

19:39 2025-03-21 UTC+2

1423

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1723

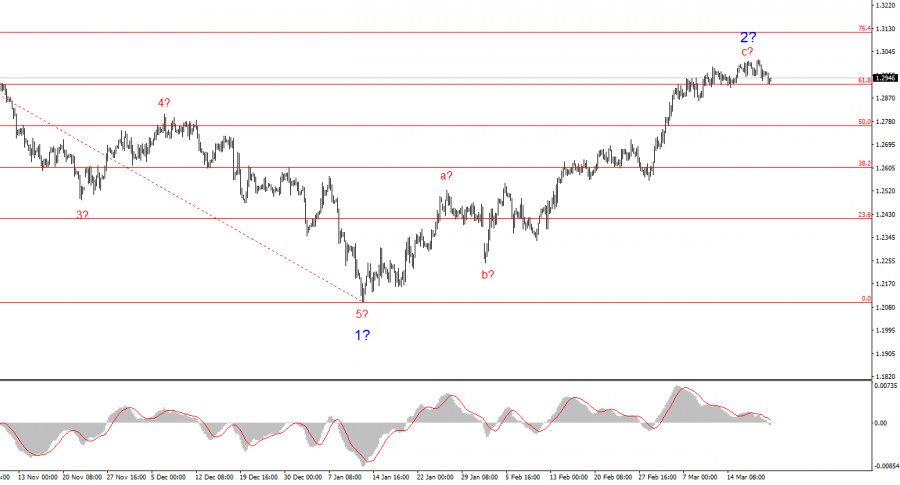

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

1693

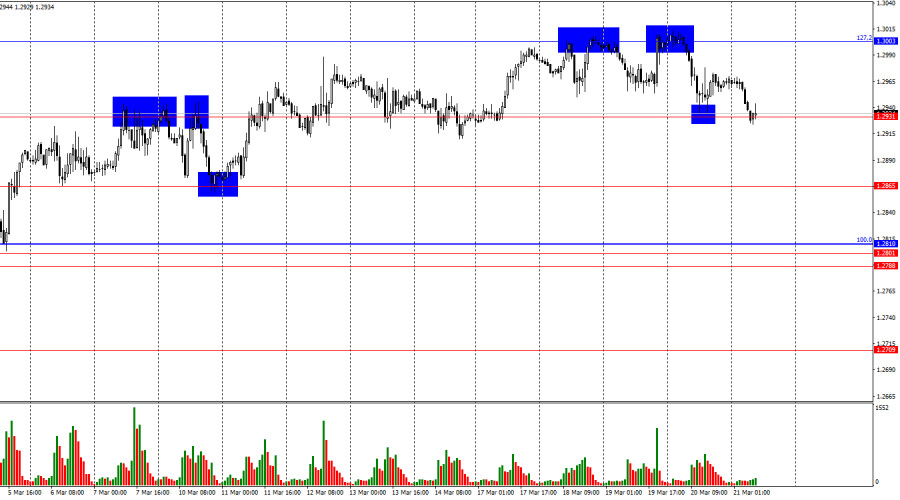

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

1603

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

1603

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

1573

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1438

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

1438

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

1423

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

1423