See also

25.04.2025 11:57 AM

25.04.2025 11:57 AMWhile Donald Trump and Beijing are still trying to figure out whether trade negotiations between the U.S. and China are happening at all, the S&P 500 continues to climb for a third straight day — this time thanks to dovish rhetoric from the Federal Reserve. FOMC member Christopher Waller suggested that tariffs would only cause a temporary increase in prices, which the Fed should ignore. However, cooling in the labor market, he said, could prompt a resumption of monetary expansion.

Markets seem to intuitively feel that the tariffs announced on America's "Liberation Day" are the limit — the White House is unlikely to go any further. Import duties will likely be reduced, and the U.S. economy is expected to avoid a recession. This is also supported by the sharp increase in durable goods orders in March. As a result, the S&P 500's late-April rally is being led by those who have suffered the most from protectionism — namely tech stocks and the "Magnificent Seven."

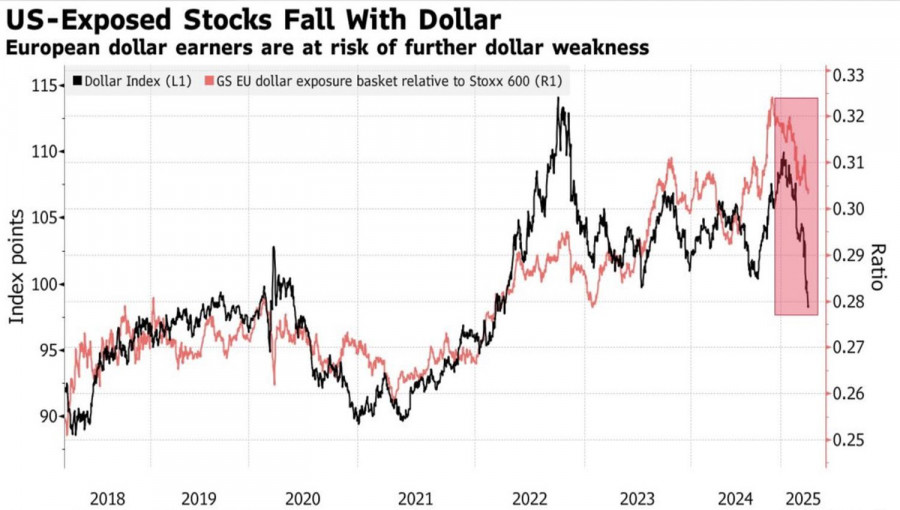

However, there are growing doubts about the wisdom of moving capital from North America to Europe. Around 60% of companies included in the EuroStoxx 600 index generate their revenues abroad. A weaker U.S. dollar negatively impacts their financial performance.

U.S. Dollar vs. EuroStoxx 600 Basket Dynamics

At the same time, a falling dollar isn't great news for the U.S. market either. Only about one-third of S&P 500 companies are export-oriented — their foreign currency revenues will rise. But two-thirds are focused on the domestic market. Rising import prices reduce Americans' purchasing power and cut into corporate revenues.

The current S&P 500 rally has limited upside, as the White House shows no signs of abandoning its tariff policies or its push to bring manufacturing back to America. Escalation of the trade war with China is only a matter of time. Furthermore, the uncertainty surrounding Washington's protectionist policies will inevitably impact the U.S. economy, reviving recession concerns.

U.S. Dollar vs. S&P 500 Earnings Outlook

Given this backdrop, the most likely scenario is a period of consolidation for the broad stock index. The exact range of this consolidation will become clearer over the next few trading sessions.

Thus, in the U.S. stock market, fear has temporarily given way to greed, allowing the S&P 500 to recover part of its losses and exit correction territory. Currently, the index is down less than 6% for the year — compared to as much as 15% in early April.

Technically, on the daily chart, bulls have activated a "1-2-3" pattern by breaking above fair value at 5400. This allowed traders to build long positions. However, this does not signal a return to a full uptrend. On the contrary, a rejection at resistance levels of 5500, 5625, or 5695 would be a signal to take profits and possibly reverse direction. The base case remains a medium-term consolidation in the broad stock index.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Although the market has largely stopped reacting to incoming economic data—especially from the U.S.—and is more focused on the geopolitical and economic moves of Donald Trump, who is steering

There are only two macroeconomic reports scheduled for Tuesday. Although the first report looks significant on its own and the second one is directly related to the U.S. labor market

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.