See also

24.04.2025 08:58 AM

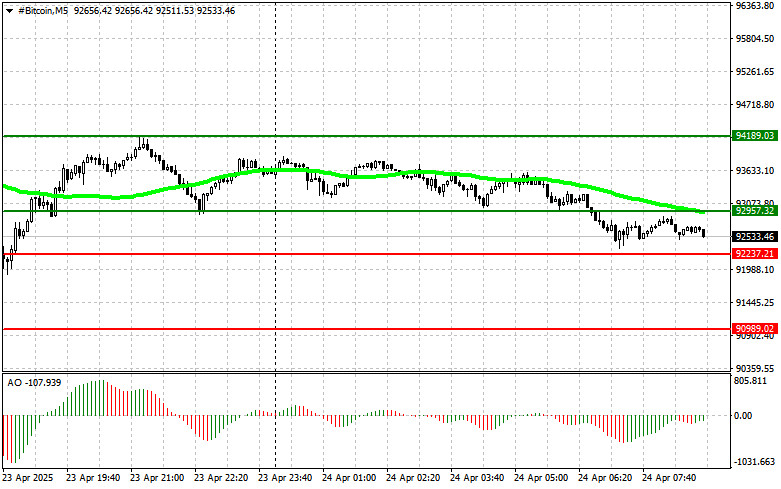

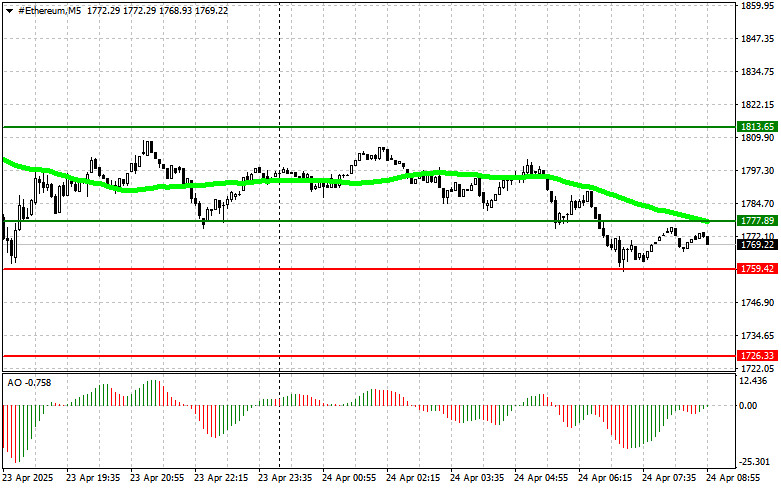

24.04.2025 08:58 AMBitcoin failed to hold above the $94,000 level and corrected to the $92,500 area, where it appears more comfortable. Ethereum also pulled back to around $1,769 after briefly climbing above $1,830.

Meanwhile, following Bitcoin's rise above $94,000 yesterday, the Fear and Greed Index jumped to 72 points, indicating a state of "greed." Bitcoin also surpassed both silver and Amazon in terms of market capitalization. This rally reinforced its position as the dominant force in the cryptocurrency market and renewed interest from traditional financial institutions and retail investors.

Bitcoin's impact on the global economy is becoming increasingly clear, especially considering its market capitalization. By exceeding Amazon in value and overtaking silver, Bitcoin is proving its ability to compete with traditional assets. The key question is whether it can sustain this momentum and continue its ascent or whether a correction is inevitable. Time will tell, but one thing is certain: Bitcoin has permanently reshaped the financial landscape.

As for the intraday strategy in the crypto market, I'll continue focusing on major pullbacks in Bitcoin and Ethereum as opportunities to trade within the framework of a still-intact medium-term bullish trend.

Below are the short-term trading strategies and conditions:

Scenario 1: I plan to buy Bitcoin today at the entry point of around $92,900, targeting growth toward $94,200. I will exit the long position at nearly $94,200 and open a sell position on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy Bitcoin from the lower boundary of $92,200 if there is no market reaction to its breakout, with a return toward $92,900 and $94,200.

Scenario 1: I plan to sell Bitcoin today at the entry point of around $92,200, targeting a drop toward $90,800. I will exit the short position at nearly $90,800 and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Bitcoin from the upper boundary of $92,900 if there is no market reaction to its breakout, with a return toward $92,200 and $90,900.

Scenario 1: I plan to buy Ethereum today at the entry point of around $1,777, targeting growth toward $1,813. I will exit the long position at nearly $1,813 and sell immediately on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario 2: Buy Ethereum from the lower boundary of $1,759 if there is no market reaction to its breakout, with a return toward $1,777 and $1,813.

Scenario 1: I plan to sell Ethereum today at the entry point of around $1,759, targeting a drop toward $1,726. I will exit the short position at nearly $1,726 and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Sell Ethereum from the upper boundary of $1,777 if there is no market reaction to its breakout, with a return toward $1,759 and $1,726.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

Bitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospects

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.