See also

18.04.2025 09:16 AM

18.04.2025 09:16 AMWill the White House cross the Rubicon by initiating the dismissal of Jerome Powell from his position as Chair of the Federal Reserve? That would deal another blow to financial markets, but for now, the S&P 500 has reacted calmly to the barrage of criticism from Donald Trump toward the central bank's head. Trump claims he never liked Powell and accuses him of playing political games by refusing to cut interest rates. Meanwhile, everything is falling—oil and gasoline—except the cost of borrowing in the U.S. remains high. Is it time to change horses midstream?

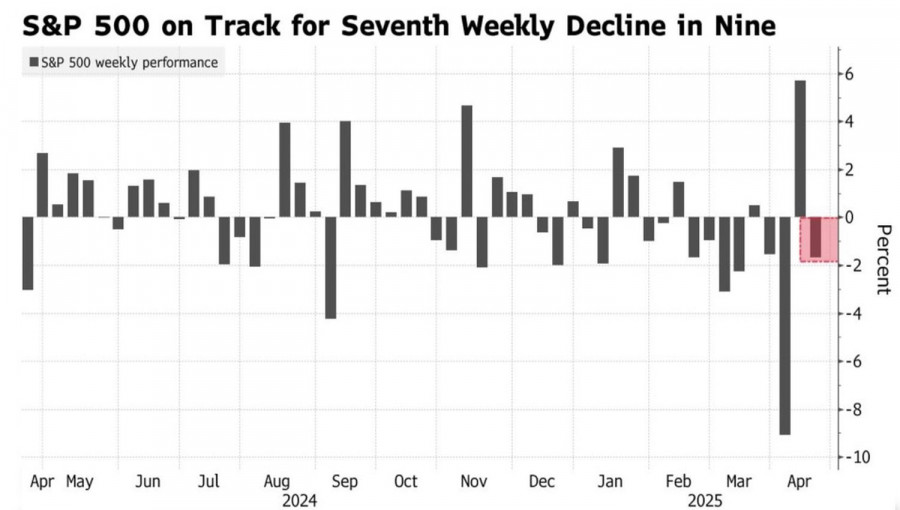

The S&P 500 has declined in seven of the past nine weeks, reacting sharply to developments surrounding the White House's tariff policies. Meanwhile, the U.S. administration is doing everything possible to create an optimistic backdrop. Trump and Treasury Secretary Scott Bessent emphasize progress in talks with Japan; the president says he no longer wants to raise tariffs against China, and a deal with the European Union is "almost in the bag." According to him, the U.S. has everything Europe wants, so a trade agreement is inevitable.

How much higher can it go? The official tariff on Chinese imports stands at 145%, but levies reach up to 245% for some goods. For instance, after a 25% tariff on electric vehicles imposed during Trump's first term, Joe Biden raised it to 100%, and now the Republican contender has added another 145%. He urges Beijing to return to negotiations, arguing that the longer China delays, the more detrimental it will be for bilateral trade.

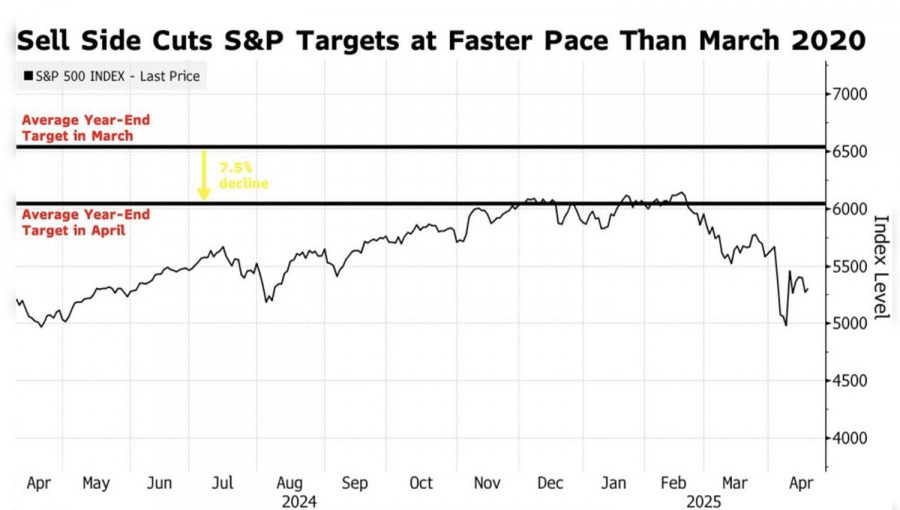

It's clear that the S&P 500's decline and temporary dip into "bear market" territory made an impression on the White House occupant. The broad equity index still has the potential to rise, as updated forecasts from Bloomberg analysts indicate.

There's both bad and good news. The median forecast for the end of 2025 has been revised from 6,539 to 6,047, indicating a 7.5% decline. Even during the height of the COVID-19 pandemic and the ensuing recession, analysts only trimmed their projections by 5%. This signals that we're witnessing tectonic shifts in the market. The good news is that if the consensus forecast materializes, the S&P 500 could climb by about 14% from current levels.

I believe the market will continue to be affected by increased volatility. Until the situation with White House tariffs and their impact on the U.S. economy becomes clearer, investors will lack enthusiasm for buying American stocks, especially now that New York Fed President John Williams has echoed Jerome Powell's stance on keeping the federal funds rate elevated.

Technically, the daily chart of the S&P 500 has formed an inside bar. This provides grounds to place pending buy orders from 5,335 and sell orders from the lower boundary of 5,215. If triggered, the latter could present an opportunity to build on previously opened short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The turbulence of recent months, driven by Donald Trump's actions and the release of fresh U.S. economic data, has done little to help investors understand the true direction of asset

The GBP/USD currency pair failed to show any decisive movement on Friday—it neither rose nor fell significantly. Many analysts interpreted the U.S. labor market and unemployment data as positive simply

The new week promises to be informative for EUR/USD traders. Most notably, the next Federal Reserve meeting, scheduled for May 6–7, will determine the central bank's future course of action

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.