See also

19.03.2025 07:44 AM

19.03.2025 07:44 AMThere are few macroeconomic events scheduled for Wednesday, which suggests that volatility for both currency pairs may remain low until the evening. The dollar continues to show signs of weakness, but what can we expect from it moving forward? The Eurozone will release its second estimate of February inflation; however, these revisions rarely differ from the initial readings, so no significant market reaction is anticipated. No other macroeconomic reports are planned for the day.

The most important event on Wednesday will be the Federal Reserve meeting. While the decision on the key interest rate is predictable, Jerome Powell's press conference and the "dot plot" chart could provide valuable insights. Currently, monetary policy is not the primary focus for traders, but this event may still provoke a notable market reaction.

According to the previous "dot plot" forecast, two rate cuts were expected in 2025. If today's chart indicates more or fewer expected cuts, this could influence trading strategies regarding the dollar. Powell's rhetoric will also be critical—if he adopts a more dovish tone, it may further weaken the dollar. However, by Thursday, we expect the market to revert to its main trend of selling the dollar, largely due to Donald Trump's policies.

Throughout Wednesday, both currency pairs could fluctuate in any direction, as the market is currently driven by emotions, with Donald Trump being the primary influence. A brief market "storm" may occur in the evening, temporarily strengthening the dollar. Nevertheless, monetary policy—even from the Fed—is not the key factor shaping market prices at this moment. The market is bracing for an all-out trade war between the U.S. and the EU, which continues to exert downward pressure on the dollar.

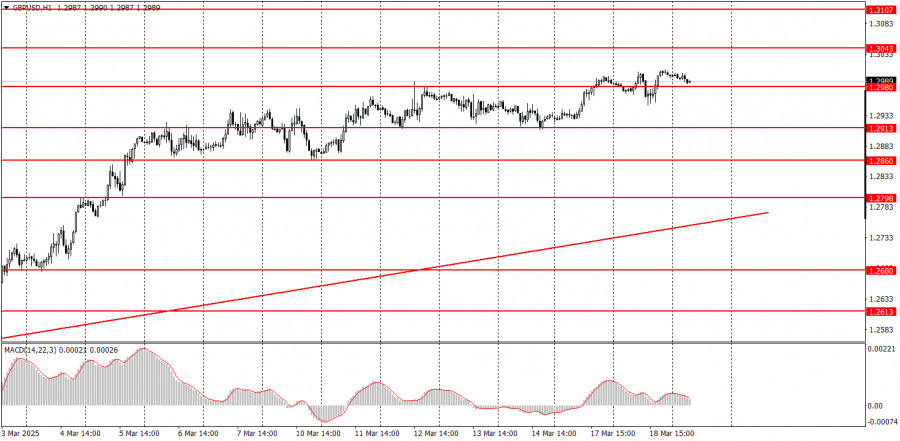

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.