See also

05.03.2025 01:30 PM

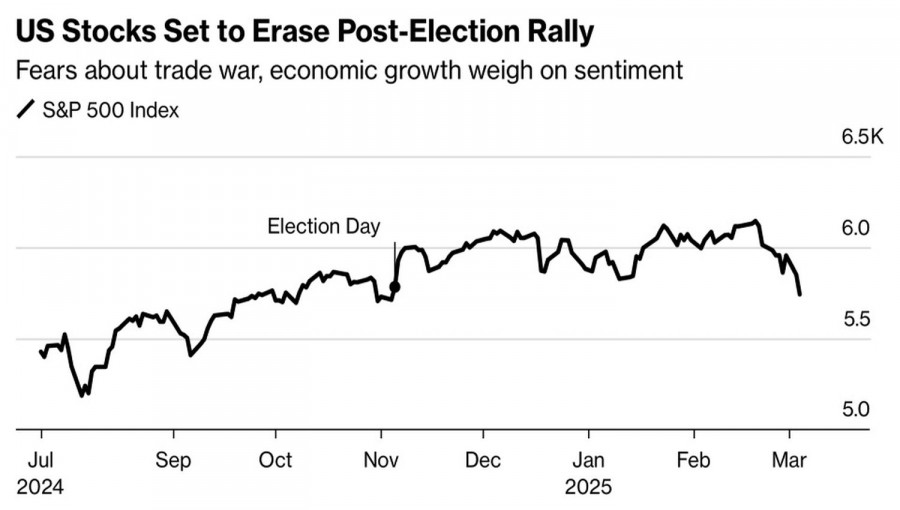

05.03.2025 01:30 PMThe rally did not last long, and neither did the S&P 500. From the US presidential election to its February highs, the broad stock index gained over $3.4 trillion in market capitalization. However, Donald Trump wiped out these gains by imposing 25% tariffs on Mexico and Canada, forcing investors to pull their money out. The stock market returned to where it was when the Republican won. Does this leave room for a deeper correction?

As the S&P 500 kept moving downwards, investors speculated on when the White House would throw it a lifeline. Some believed it would happen when the index dropped back to pre-election levels. Others pointed to a 10% decline, recalling similar patterns from Trump's first term. Now that this drop has materialized, the president remains silent. However, his commerce secretary, Howard Lutnick, has hinted at a possible deal with Canada and Mexico. Could this be Trump's version of a put option?

S&P 500 Performance

According to Treasury Secretary Scott Bessent, the stock market is enduring short-term tariff pain for the sake of long-term prosperity. However, confidence in this vision is fading. A string of disappointing macroeconomic reports has led the Atlanta Fed's leading indicator to signal a US GDP contraction as early as the first quarter. Fears of a recession are sending investors fleeing like rats from a sinking ship, dragging the S&P 500 down.

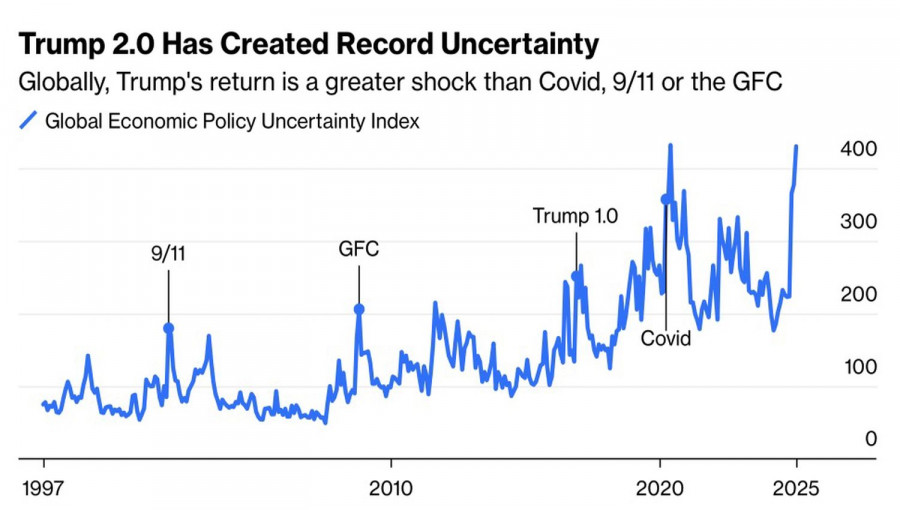

It is, of course, too early to draw long-term conclusions based on just a few reports. However, the White House has pushed uncertainty to extreme levels, making business planning difficult and impacting the US economy. The situation is also aggravated by retaliatory measures from other countries and Elon Musk's initiative to downsize the federal government. If history repeats itself, just as in Trump's first term when the US faced an economic downturn toward the end, another recession may be on the horizon.

Economic Policy Uncertainty Trends

Will Donald Trump even bother to save the S&P 500? Judging by his social media activity, he seems to have lost interest in the stock market. During his first term, he mentioned it 156 times, 60 of which were in the first year alone. Since November, however, out of his 126 posts, only one referenced stock indices.

Without rolling back tariffs on Mexico and Canada, it is hard to expect the stock market to find a bottom, especially with potential new tariffs against the European Union coming in April.

From a technical perspective, the S&P 500 has already hit both short-position targets at 5,830 and 5,750 on the daily chart. A rebound from the latter resistance level increases the risk of consolidation. Given the current setup, a strategy of buying on dips and selling on rallies seems reasonable.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The challenging month of May was experienced differently across global markets, but the main beneficiaries were stocks, which gained momentum from late April and extended their rally into May—something that

Quite a few macroeconomic reports are scheduled for Monday, but only one truly important one. This concerns the U.S. ISM Manufacturing PMI. It's worth recalling that two business activity indices

The economic calendar for the upcoming week is packed with important events. The first week of every month is traditionally the most informative for EUR/USD traders, and June will

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.