See also

13.08.2024 11:23 AM

13.08.2024 11:23 AMEUR/USD

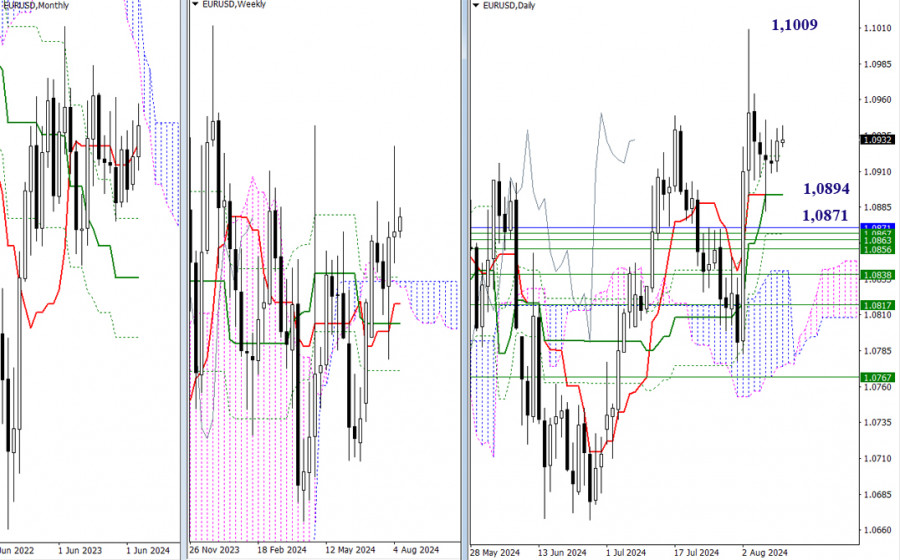

Higher timeframes

No major changes have been recorded over the past 24 hours. The EUR/USD pair remains within the current consolidation range. All previously indicated crucial levels have retained their positions. For bullish traders, it is crucial to test and overcome the nearest high at 1.1009 under the current market conditions. For bearish traders, two key levels might be significant in the near term: 1.0894 (the convergence of key daily Ichimoku levels) and 1.0871 (the monthly short-term trend, reinforcing the area of weekly support levels).

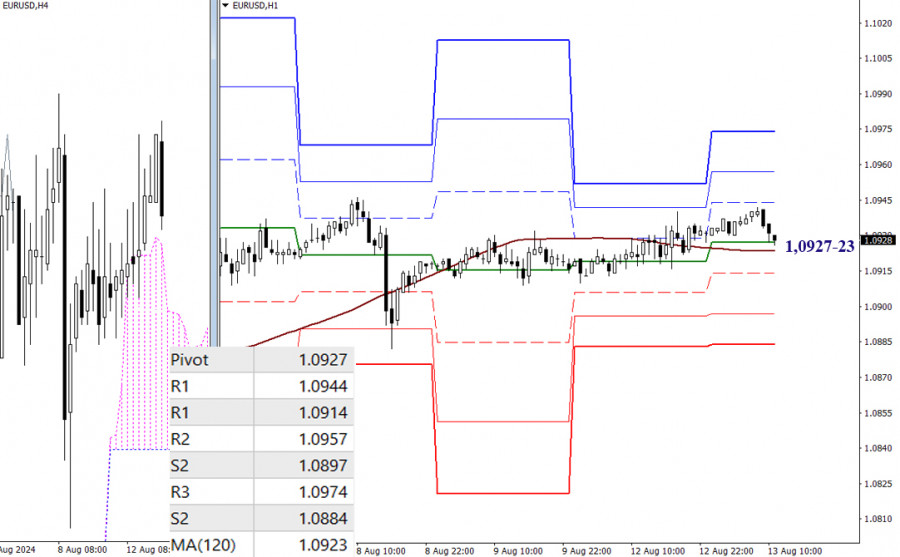

H4 – H1

Lower timeframes

Bullish traders continue to hold the upper hand on lower timeframes, as EUR/USD is trading above key levels situated close to each other: 1.0927 (the central daily Pivot level) and 1.0923 (the weekly long-term trend). However, the market is currently in a correction phase and testing key levels. The outcome of this bullish sequence could alter the existing balance of power. Should a directional movement develop, classic pivot levels may come into play. In this case, bearish traders will encounter support at 1.0914 – 1.0897 – 1.0884, while bullish traders will face resistance at 1.0944 – 1.0957 – 1.0974.

GBP/USD

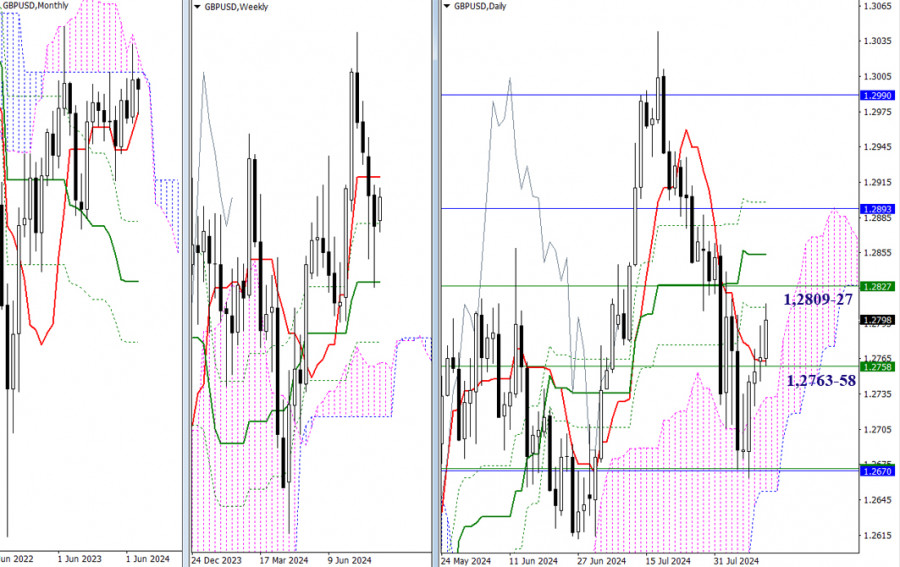

Higher timeframes

The daily short-term trend (1.2763) has not been able to halt the upward correction. EUR/USD is extending its rise. The instrument has begun testing the next resistances of the daily Ichimoku dead cross. The current level is Fib Kijun (1.2809). Bullish traders are looking ahead to 1.2827 (the weekly short-term trend), 1.2853 (the daily medium-term trend), and 1.2893-98 (the lower border of the monthly cloud + the final level of the daily cross).

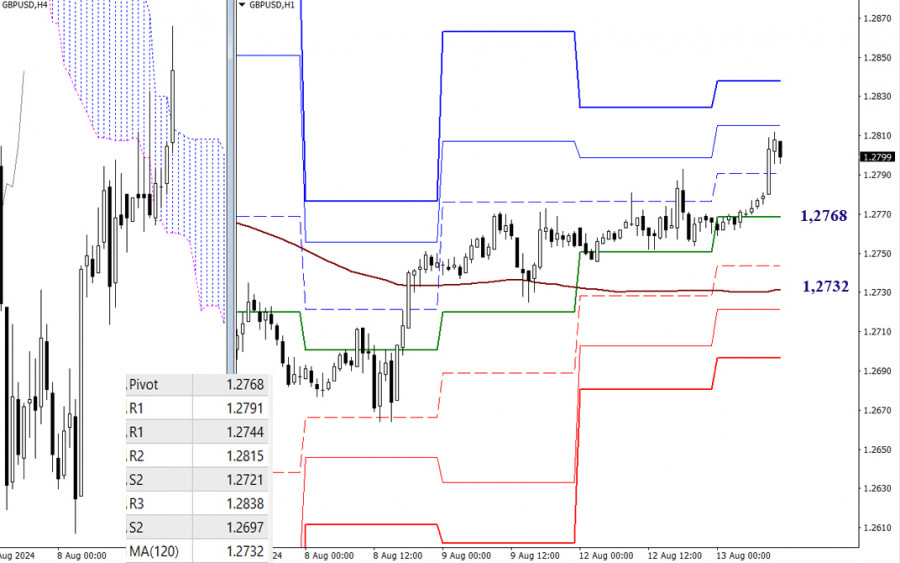

H4 – H1

Bullish traders hold the advantage on lower timeframes as well, driving the rise. Currently, they are testing the influence zone of the second resistance of the classic pivot levels (1.2815). The next bullish target remains the resistance R3 (1.2838). If priorities are revised and a corrective decline develops, the main focus will be the interaction with key lower timeframe levels, currently noted at 1.2768 (the central pivot level) and 1.2732 (the weekly long-term trend). A breakout and reversal of the trend could change the existing balance of power.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance that

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be released

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.