See also

27.12.2023 06:27 AM

27.12.2023 06:27 AMKey Points:

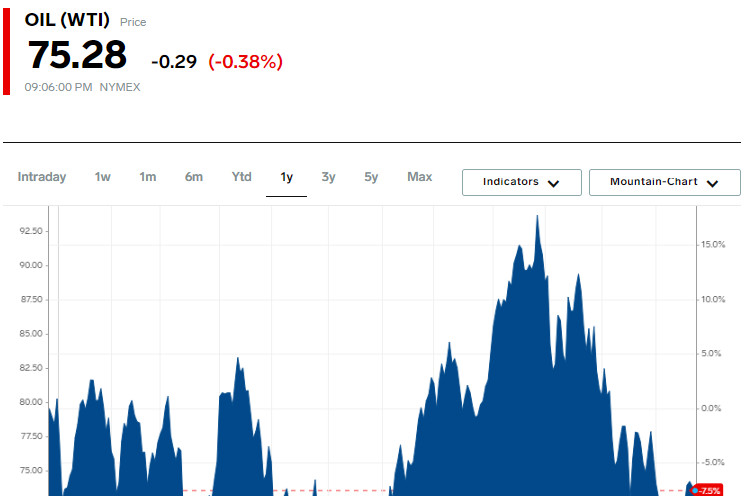

On Tuesday, oil prices reached their highest level for the month, increasing by more than 2%. This movement was fueled by concerns about potential disruptions in maritime transport following incidents in the Red Sea, and expectations of interest rate cuts that could stimulate economic growth and fuel demand.

Specific Figures:

These trends, amplified by reduced trading activity during the holidays, added to last week's 3% increase, caused by Houthi attacks on maritime vessels, raising investor concerns, and ongoing violence in the Gaza Strip.

John Kilduff from Again Capital LLC emphasized: "Today's geopolitical tension in the Middle East raises serious concerns about the safety of transporting oil and other goods."

Houthi military actions, including a missile attack on a container ship in the Red Sea and attempts to strike Israel using drones, only intensify this concern.

On the other hand, the increase in oil demand, spurred by the recovery of the global economy post-pandemic, has stimulated buyer interest. Major oil companies such as Exxon Mobil, Chevron Corp, and Occidental Petroleum have made significant investments, totaling $135 billion in 2023. ConocoPhillips has entered into two major deals in the past two years, reflecting growing interest in the oil sector.

Global oil demand over the past two years has increased by approximately 2.3 million barrels per day, reaching 101.7 million barrels. This surge in demand has significantly impacted global reserves and pricing, especially considering the limited production by OPEC and its allies.

Looking Ahead:

Analysts predict that in 2024, global oil prices will remain relatively stable, fluctuating between $70 and $90 per barrel, significantly higher than the average level of $64 per barrel in 2019. This compares with an average price of around $83 per barrel in 2023 and $99 per barrel in 2022.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Major US stock indices ended the session in the green, supported by statements from Donald Trump indicating progress in negotiations over a major trade agreement. The market interpreted this rhetoric

Berkshire Hathaway Slips After Buffett Steps Down as CEO U.S. Services Sector Rising in April Skechers Jumps After $9B Privatization Deal Investors Await U.S.-Partner Trade Deals Asian Currencies in Focus

European stocks fell slightly; STOXX 600 - minus 0.1%, France - minus 0.3% Investors await data on US-China talks, earnings and Fed decision Trump: 100% tariffs on foreign films, Alcatraz

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.