See also

15.11.2022 02:28 PM

15.11.2022 02:28 PMUS stock index futures increased on Tuesday amid falling tensions between China and the US, as well as increased expectations of a Fed rate hike slowdown. S&P 500 futures went up by 0.7%, NASDAQ futures gained 1.17%, and Dow Jones futures edged up by 0.33%. US Treasury bond yields and the US dollar index slid down as tech stocks advanced. Major chipmakers, such as Advanced Micro Devices Inc., Nvidia Corp., and Intel Corp increased by 1.3%-2% in premarket trading, while Tesla Inc., Amazon.com Inc., Apple Inc., and Alphabet Inc. gained about 1%.

Softer-than-expected US economic data will allow the Fed to increase interest rates by only 50 basis points after three consecutive 75 bps moves, boosting demand for risky assets. Yesterday, Fed vice chair Lael Brainard said that reducing the pace of rate hikes may be appropriate soon. However, she warned that the Federal Reserve will not end monetary tightening or reverse its policy in the near future. The only thing optimistic investors can expect is a somewhat softer regulator stance on increasing the interest rate in early 2023.

Interest rates are about to peak, and it is unclear how long the Fed will keep them at their current high levels. Some economists believe that the Federal Reserve will have to change their policy in mid-2023 if inflation continues to decrease.

The Stoxx 600 is moving sideways despite European indexes being near a three-month high. In Germany, the DAX is close to entering a bull market after nearly closing in bullish territory on Monday. In Asia, the Hang Seng Index entered a bull market after jumping by 4.2%.

The meeting between Xi Jinping and Joe Biden on Monday gave hope to more friendly relations between the two superpowers. Meanwhile, the MSCI Asia Pacific Index surged thanks to rising Chinese tech stocks. Shares of Taiwan Semiconductor Manufacturing Co. climbed by 9.4% after the Chinese government announced measures to support the beleaguered real estate sector. Furthermore, Beijing eased some COVID restrictions in the country. However, the latest November poll by Bank of America suggests most fund managers remain highly bearish, as investors continue to choose USD and other fiat over risky assets such as tech stocks.

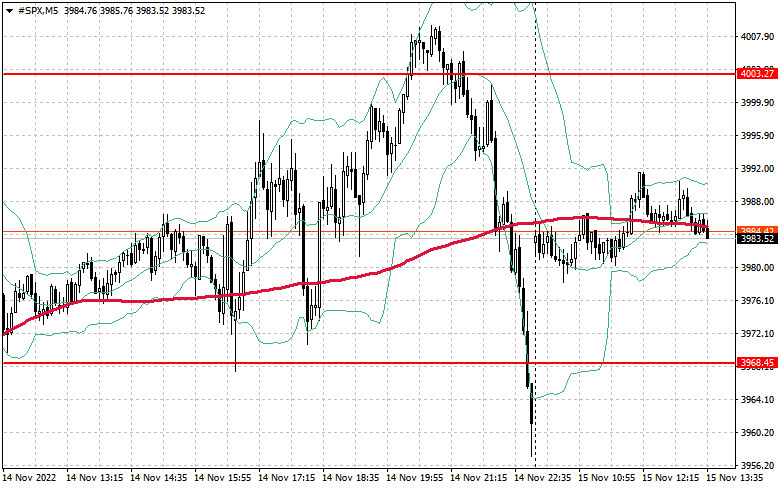

On the technical side, the S&P 500 has stabilized slightly after tumbling late on Monday. Now, bullish traders are focused on holding onto the support level of $3,968. Demand for risky assets will remain as long as the index stays above it. If the S&P 500 breaks through $4,003, it could continue its upward correction towards the resistance at $4,064, as well as $4,091 further ahead. If S&P 500 bulls fail to prevent the index from breaking below $3,968, it will quickly dive towards $3,942, as well as the support at $3,905.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.